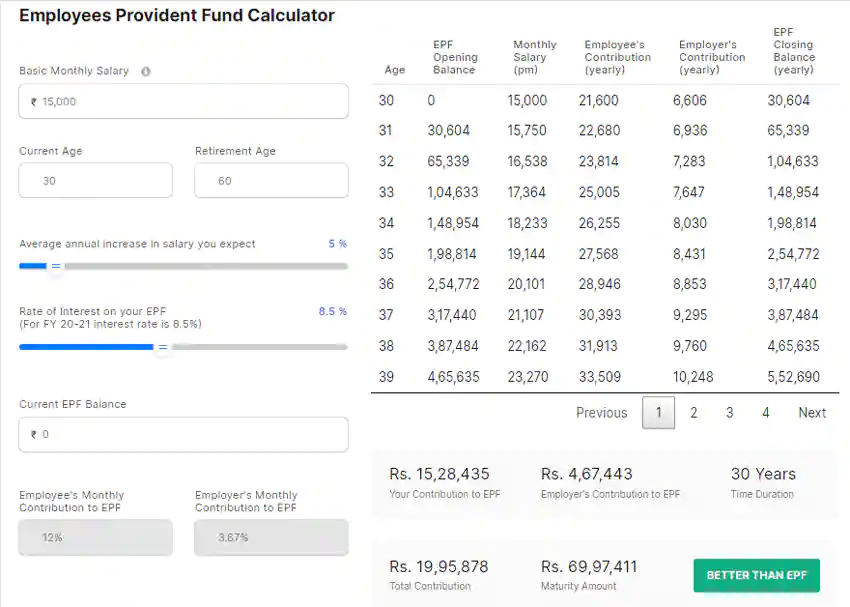

How to become Crorepati: In the new wage code, the basic salary will be 25 thousand rupees a month. Then the amount of EPF on retirement will be Rs 1,16,62,366. Here the annual increment of 5 percent has been taken, due to which the fund of EPF will increase further.

How to become Crorepati: In the new wage code, there has been maximum discussion about Cost to Company (CTC). Or from when the Wage Code will be implemented, no deadline has come yet. Preparations have been done by the Labor Ministry, but there are still some hurdles. After its implementation, there will be a big change in the Take Home Salary, EPF and Gratuity of the private job. In the new wage code, the cash in hand of private job professionals will decrease, but old age will be secure. According to experts, even though the monthly salary will decrease, there will be more reduction in EPF and this will create a bigger fund for retirement.

Understand how to get benefit

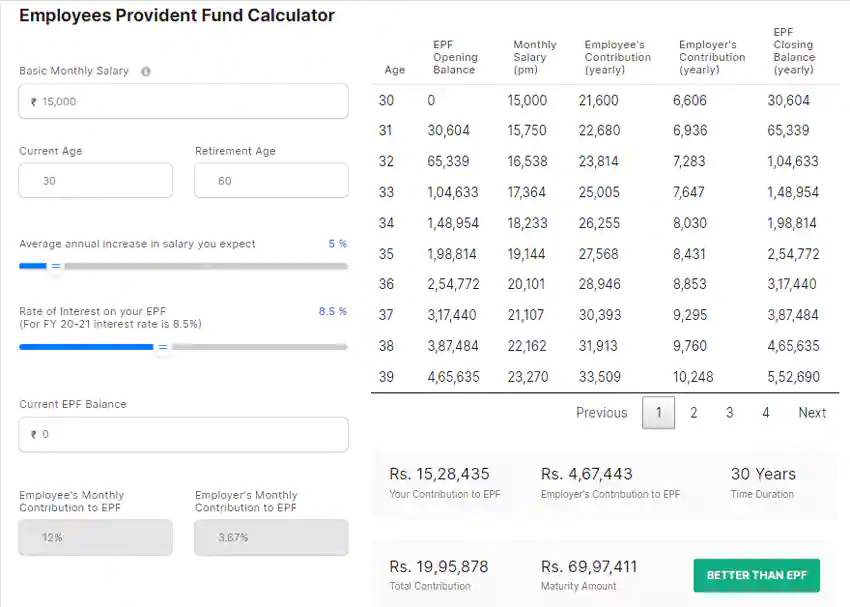

How to become Crorepati: See in the current system, if someone’s monthly salary is 50 thousand rupees and basic pay will be 15 thousand rupees. Then the amount of EPF on retirement will be Rs 69,97,411.

In the New Wage Code, the basic salary will be Rs 25,000 per month. Then the amount of EPF on retirement will be Rs 1,16,62,366. Here the annual increment of 5 percent has been taken, due to which the fund of EPF will increase further.

What is Cost to Company?

The expenditure incurred by a company on its employee is CTC. This is the complete salary package of the employee. CTC includes monthly basic pay, allowances, reimbursement. At the same time, products like Gratuity, Annual Variable Pay, Annual Bonus are included on an annual basis. The amount of CTC is never equal to the take home salary of the employee. There are many components in CTC so it is different. CTC = Gross Salary + PF + Gratuity

Basic salary

Basic salary is the base income of an employee. It is fixed on the basis of the level of all the employees. It is according to the post of the employee and the industry in which he is working.

Gross salary

Salary which is made by adding basic pay and allowances without deducting tax is called gross salary. This includes bonus, overtime pay, holiday pay and other allowances.

Gross Salary = Basic Salary+HRA+Other Allowances

Net salary

Net salary is also known as take home salary. The salary that is made after deducting tax is called net income.

Net Salary = Basic Salary + HRA + Allowances – Income Tax – EPF – Professional Tax

What are the allowances?

- The company gives allowances to the employee in lieu of the job. It can be different in every company.

- HRA: House Rent Allowance is given to the employee in lieu of the house on rent.

- LTA: LTA is the expenditure given to the employee on domestic travel. It does not include fooding, hotel fare.

- Conveyance allowance: Conveyance allowance is given to the employee in lieu of the expenses incurred in going from office to home.

- Dearness allowance: DA is an allowance related to livelihood. It is given in lieu of inflation. Its eligible are government employees and pensioners.

- Other allowances include special allowance, medical allowance and incentive.

What is the rule regarding reimbursement?

EPF Calculator: According to experts, in many companies there is a provision to reimburse the employee for treatment, phone expenses, newspaper bills. This amount is received separately from the salary. But only after paying the bill. Every reimbursement is tax exempt up to a limit under the Income Tax Act.