The new PAN card rules are expected to widen the tax base and help the tax authorities to have more control on entities entering into financial transactions above the specified limit and taking benefit of legislative loopholes.

With a view to expand the tax base, bring transparency and prevent tax evasion, the Modi government had amended the provisions related to the PAN card in the Union Budget 2018 and also expanded the scope of persons who would be mandatorily required to obtain PAN (Permanent Account Number).

As per the amended provisions, a resident (other than an individual) who enters into a financial transaction aggregating to Rs 250,000 or more in a financial year is mandatorily required to apply for and obtain a PAN card. This brought entities like companies, partnerships, LLPs, Trust, etc under the purview of PAN, subject to the financial transaction threshold.

“The expanded provisions also made PAN mandatory for key managerial personnel in such resident entities, ie Managing Director, Director, Partner, Trustee, Author, Founder, Karta, Chief Executive Officer, Principal Officer or office bearer of the entities as mentioned above. Such personnel would also be required to apply for a PAN (if not already allotted) within the prescribed timeline. However, the timelines within which PAN was to be applied for by the resident entities or its key personnel had not been prescribed,” says Akhil Chandna, Director-Tax, Grant Thornton India LLP.

1. The government recently amended the rules to prescribe the time within which such resident entities or the key personnel are required to apply for a Permanent Account Number. The new ‘PAN rules’, as referred to in common parlance, have become applicable from December 5, 2018.

Resident entities need to file the PAN application on or before 31 May immediately following the financial year in the financial transaction was entered into. For example, in case of financial transaction entered into Financial Year 2018-19, the application has to be filed on or before 31 May 2019.

2. The key managerial personnel, Managing Director, Director, Partner, Trustee, Author, Founder, Karta, Chief Executive Officer, Principal Officer or office bearer of the entities, as mentioned above, would also be required to apply for a PAN within the timeline as applicable to the resident entity in which they hold such position.

“It may, however, be noted that the PAN-related provisions do not define the type of ‘financial transactions’ which are covered for this purpose and a clarity in this regard would be welcome. Also, important to note that the key managerial personnel to whom these provisions apply need not be residents. Therefore, a non-resident individual who is a key managerial person in any covered resident entity would now be required to apply for a PAN in India,” informs Chandna.

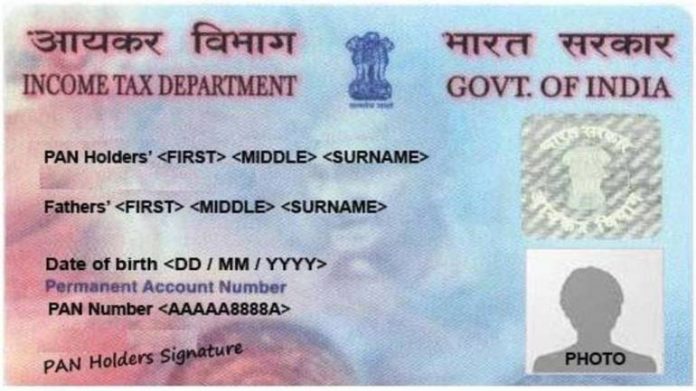

3. In addition to the above amendment, the tax department has also introduced certain changes in the PAN form. This includes doing away with the requirement of quoting father’s name in PAN applications where the applicant’s mother is a single parent. Currently, furnishing father’s name is mandatory for submitting an application for a PAN card. This was a long-standing request that the government finally accepted.

These PAN rules have become applicable from December 5, 2018.

4. Apart from the above rules, some other PAN card rules have also been introduced by the government during the last year. For instance, the Central Board of Direct Taxes (CBDT) added another option (i.e. ‘Transgender’) in Gender column of Form 49A/ 49AA (for PAN Application), against the earlier options of ‘Male and Female’ for Individual Applicants, vide Income–tax (Fourth Amendment) Rules, 2018 Notification No. 18/2018, dated 9 April, 2018. Thus, promoting equal rights for every citizen, the PAN application form is now having the option of Transgender, in addition to Male & Female.

“The new PAN card rules are expected to widen the tax base and help the government and tax authorities to have more control on entities entering into financial transactions above the specified limit and taking benefit of legislative loopholes,” says Chandna.