There are more than 50 plus travel insurance plans available in the market.

While planning to go on an overseas vacation, it is important to choose the right travel insurance plan for yourself or for your family as a whole. Having travel insurance ensures that your finances will be taken care of in case of some untoward incident during the trip. But when it comes to choosing the right plan, insurers may give you lofty discount offers and you may end up choosing a wrong one. Therefore, it is important that you do not blindly trust your travel agent, but research and compare online before you buy.

Mahavir Chopra, Director – Health, Life & Strategic Initiatives – Coverfox.com told Moneycontrol that there are more than 50+ travel insurance plans available in the market. A travel insurance has nearly 20+ covers related to health risks, travel risks and some miscellaneous risks with respect to liability as well as loss of documents. You must inquire in detail about the primary medical cover or sum insured, which covers hospitalization, dental as well as outpatient medical expenses. This cover should be based on the city as well as the duration of the visit. The longer the stay, the larger the risk. “Next, you should compare the trip- related covers like Trip Delay, Trip Cancellation, Baggage Delay and Baggage Loss. Make sure you are aware and understand the deductibles in each of these covers,” he added.

Nowadays, insurance companies provide cover for pre-existing diseases. It is important to take any kind of existing disease of traveller’s into account. Thus, you must ensure your policy covers existing diseases as well.

Here are 5 important clauses Tarun Mathur- Director, Policybazaar.com told Moneycontrol that one should look at while buying a travel insurance before going abroad.

Financial Emergency assistance

The emergency cash feature (financial emergency assistance) works like an emergency loan, which can come in handy if you lose your wallet. This feature is available only with some insurance companies and it is important to know the amount of money you can take from your insurer since the limit varies from insurer to insurer.

Checked-in baggage loss

This benefit covers the loss of your checked baggage while going abroad, and pays for the cost of replacement of the essential items in the baggage. One more thing you must know is that loss of checked baggage is only covered when you are going abroad and not when you are coming back.

Flight delay

Flight delay can result in the various type of losses, to hedge the same loss, majority of insurance companies offer insurance benefits if your flight gets delayed for more than 12 hours due to strike, bad weather condition or technical/mechanical failure. Having this benefit in your travel insurance policy can offer some relief. Furthermore, few insurers offer insurance benefits if your flight is delayed by more than 4 hours. This makes knowing all the conditions of your travel insurance policy important.

Hospital Cash

While in-patient expense cover is the default benefit of all travel insurance plans. Out of the pocket expense, which is not covered in hospitalisation can have a serious impact on your travel budget. These benefits are only limited to out of pocket expenses which are related to hospitalisation only. For instance, taxi fares. Hence, opt for a travel insurance, which also covers you against out of pocket expenses related to the hospitalisation.

Loss of passport

The worst thing that can happen to someone is to lose his or her passport while travelling abroad. Apart from the inconvenience that you may face, passport loss can ruin your travel plan, while the loss of passport is covered in the majority of travel insurance policies. What you must look for is how much cover is being provided. It is recommended to compare multiple policies and purchase the one, which offers maximum cover against loss of passport.

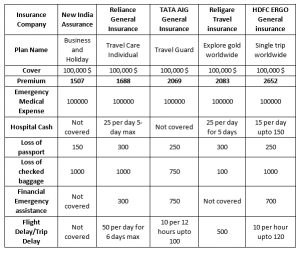

Here is a comparison of some plans for your reference: