If you are a risk-taker, then a sneak peek into his portfolio for the June quarter will reveal plenty of stocks that hold the potential to deliver good returns

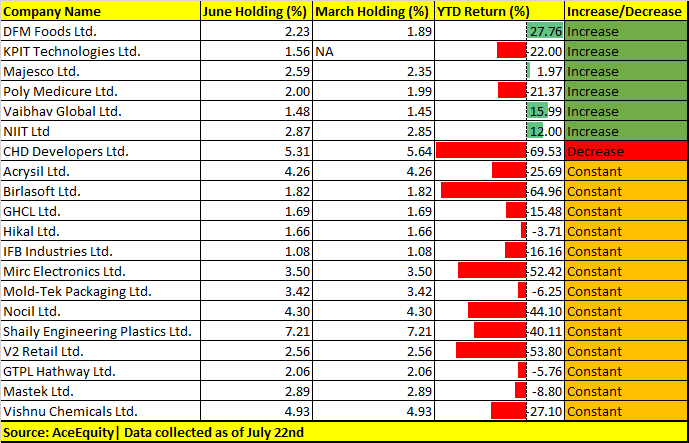

Ashish Kacholia, an expert at spotting hidden treasures in the small and mid-cap universe, increased stake in six companies during the June quarter and kept it constant in 13, as per the shareholding data as of July 22. He also reduced stake in three companies.

Six companies in which Kacholia increased stake are DFM Foods, KPIT Technologies, Majesco, Poly Medicure, Vaibhav Global and NIIT Ltd.

Stocks of four of the above-mentioned companies have given a positive return in 2019 so far. The other two, however, are down over 20 percent year-to-date.

If you are a risk-taker, then a sneak peek into his portfolio for the June quarter will reveal plenty of stocks that hold the potential to deliver good returns.

Table: Seven of the 22 companies in which Ashish Kacholia tweaked his stake in the April-June period. The table also lists 13 companies in which he kept his stake constant. The list is not exhaustive and includes only those companies in which Kacholia holds over 1 percent stake as of July 22.

Kacholia reduced stake in three companies in June quarter—CHD Developers, Beta Drugs and Pokarna.

Stock price of CHD Developer has fallen nearly 70 percent so far in 2019. The company is among the top builders in Delhi-NCR and Haryana.

In Beta Drugs and Pokarna, Kacholia either exited or reduced the stock below 1 percent in June quarter.

He kept his stake constant in 13 companies for the quarter ended June all of which have given negative return so far in 2019. They include Acrysil, Birlasoft, GHCL, Hikal, IFB Industries, Mirc Electronics, Mold-Tek Packaging, Nocil, Shaily Engineering, V2 Retail, GTPL, Mastek and Vishnu Chemicals.