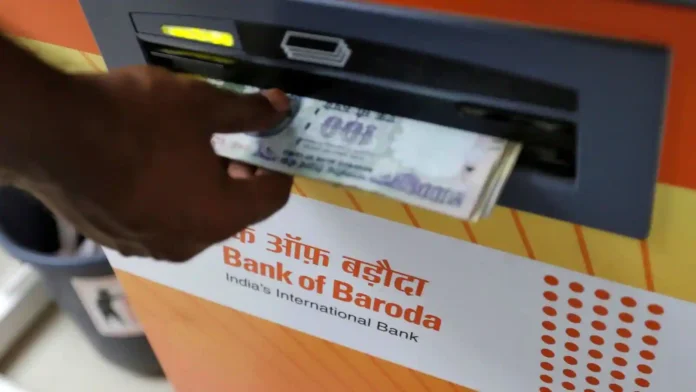

ATM Withdrawals New Charges: If you withdraw money from ATM machine, then there is big news for you. According to a report, withdrawing cash from ATM may become costly in the coming days.

ATM Withdrawals New Charges: If you withdraw money from ATM machine, then there is big news for you. According to a report, withdrawing cash from ATM may become costly in the coming days. Actually, according to the report of DD News on Tuesday, withdrawing cash from ATM is going to be expensive from May 1. This is because the Reserve Bank of India (RBI) has increased the interchange fee. This increased fee will be applicable when customers withdraw cash from other ATMs even after exceeding the free transaction limit. Let us tell you that the limit of free transactions from ATMs of other banks is five in metro cities and three in non-metro cities. Additional charges will be levied on subsequent transactions. ATM interchange fee is a fee that one bank pays to another bank for providing ATM services. This fee, usually a fixed amount per transaction, is often passed on to customers as part of their banking costs.

How much will be charged for which service?

From May 1, customers will have to pay an additional Rs 2 for each financial transaction beyond the free limit. Charges for non-financial transactions, such as balance inquiries, will increase by Rs 1. As a result, withdrawing cash from an ATM will cost Rs 19 per transaction, up from Rs 17 earlier. Checking account balance will now cost Rs 7 per transaction, according to the official notification.

Why was this decision taken?

The RBI decided to revise these charges following requests from white-label ATM operators, who argued that rising operational expenses were affecting their business. The hike in charges will be applicable across the country and is expected to impact customers, especially those of smaller banks. These banks depend on larger financial institutions for ATM infrastructure and related services, making them more vulnerable to rising costs.

Demand for ATM has decreased due to increase in UPI payments

Let us tell you that ATM was once seen as a revolutionary banking service. However, it is struggling in India due to the rise of digital payments. The convenience of online wallets and UPI transactions has significantly reduced the need for ATM cash withdrawals. Government data shows that the value of digital payments in India in FY 2014 was Rs 952 lakh crore. By FY 2023, this figure has increased to Rs 3,658 lakh crore, indicating a massive shift towards cashless transactions.

Most Read Articles:

- Bank New Charges: Big news! Bank is not imposing charge only ATM transaction they also charge cheque book and bank transaction

- UPI New Guidelines: UPI users alert! There will be a big change in UPI from April 1! NPCI issued new guidelines

- Credit Card Link UPI: Link your credit card to UPI from home, know step-by-step guide