Axis Bank MCLR: After SBI, now Axis Bank has also increased its MCLR by 0.05 percent. The new rates are applicable from April 18.

Axis Bank MCLR: After State Bank of India (SBI), now taking loan from private bank Axis Bank is also going to be expensive. Axis Bank has increased the MCLR rates by 0.05 percent. The bank said that the new rates of MCLR will be applicable from April 18, 2022. Earlier, SBI has also increased its MCLR rates.

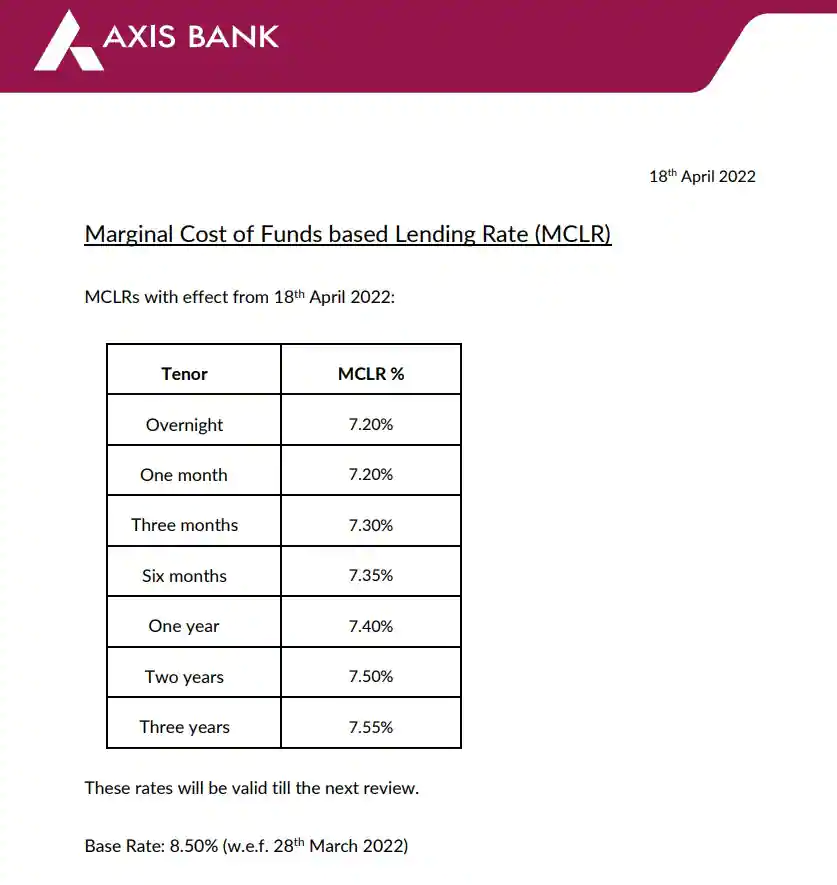

What are the latest rates

Axis Bank’s new rates of MCLR from overnight to one month are 7.20%. This rate is 7.30% for three months, 7.35 percent for six months and 7.40% for one year.

According to the official site of Axis Bank, the rate of MLCR for two years is 7.50 percent and for three years is 7.55 percent.

SBI also increased rates

Let us inform that earlier State Bank of India (SBI) has also increased its MCLR rates by 0.10 percent. SBI’s MCLR rate ranges from 6.65 percent to 7.40.

What is MCLR?

The MCLR system in India was introduced by the Reserve Bank of India in 2016. It is an internal benchmark for a bank. In MCLR, the minimum interest rate for giving loans to banks is fixed.