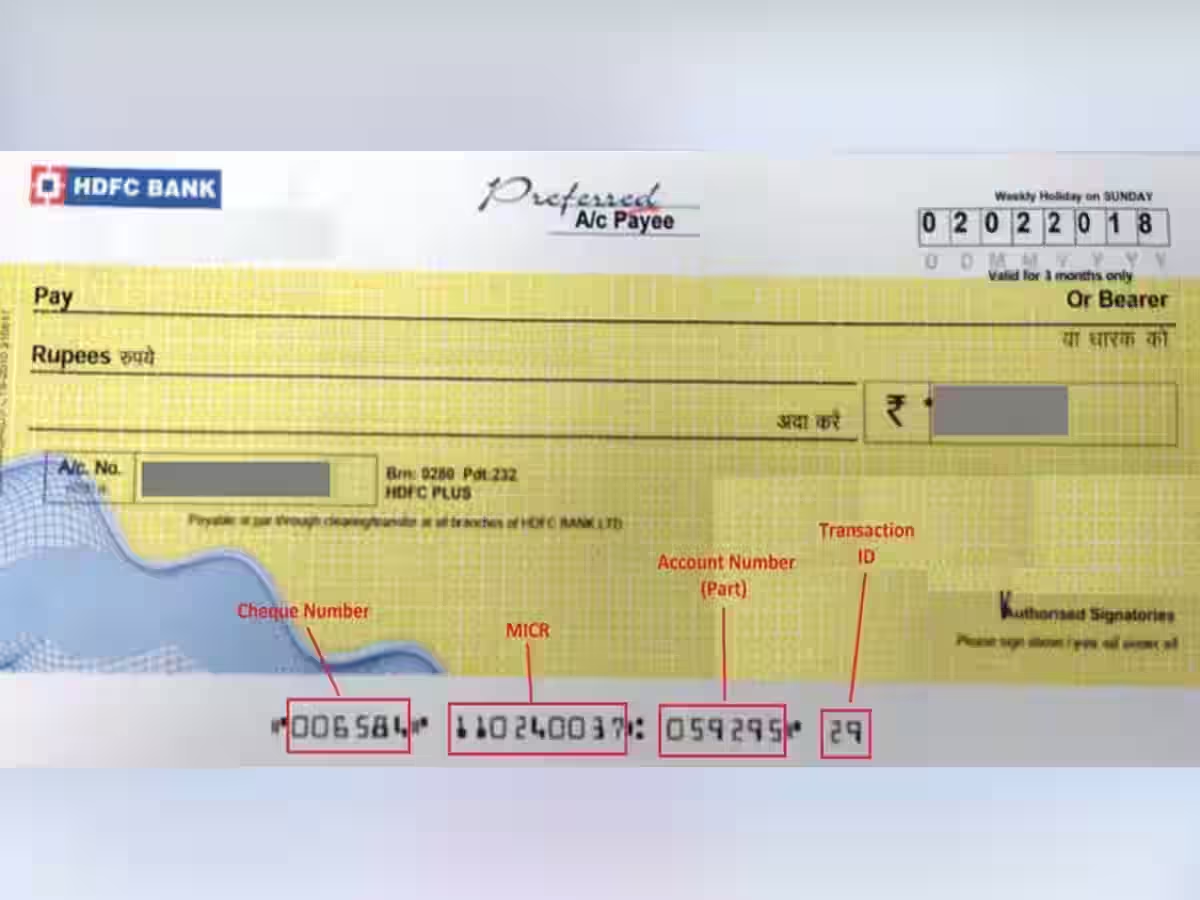

Bank Cheque Rule: Many people use bank cheques. Banks are a very safe way to do any financial transaction. If you also use cheques, then you must have noticed that every cheque has some numbers written at the bottom. By looking at these numbers, you can understand many things related to the cheque. These numbers are the security features of the cheque. There are very few people who know the true meaning of these numbers. Let us know about them.

1- Cheque number

The numbers written on the cheque tell its complete horoscope. The first is the cheque number, which is of 6 digits. For any kind of record, the cheque number is seen first. If you are issuing a cheque to someone, then the most important thing is the cheque number.

2- MICR code

It means Magnetic Ink Character Recognition (MICR). This code is read by a special cheque reading machine, which helps banks to find out the branch from which the cheque has been issued. It is a 9 digit number, which is divided into three different parts.

3- City code

The first 3 digits of the MICR code are the city code. These are the first three digits of your city’s PIN code. By looking at this number, you can find out from which city your cheque has come.

4- Bank code

The next 3 digits of the MICR code are a unique code of the bank. With this code, you can find out the bank. That is, this code determines which bank the cheque belongs to. For example, the code of ICICI Bank is 229 and the code of HDFC Bank is 240.

5- Branch code

The last 3 digits of the MICR code are the branch code. Every bank has its own branch code. This code is used in every transaction related to the bank. By looking at this code, you can understand from which branch that cheque has been issued.

6- Bank account number

There is another special number present in your cheque. This is your bank account number. It is in the new cheque book. If you look at the old cheque books, which were printed before Core Banking Solution, this number was not there in them.

7- Transaction ID

The last 2 digits of the numbers printed at the bottom of your cheque represent your transaction ID. 29, 30 and 31 represent at par cheques. Whereas 09, 10 and 11 represent local cheques.

Related Articles:

Bank FD Rates: These banks are offering 9.5% interest on fixed deposits, check FD details

FD Rate: These 10 banks are giving strong returns, senior citizens will get interest up to 8.05%