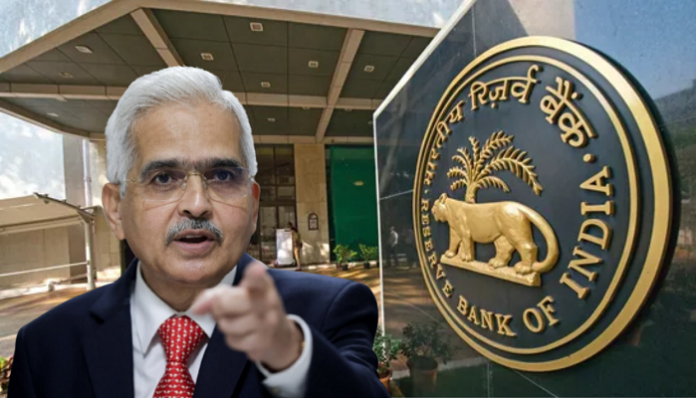

The Reserve Bank of India (RBI) is taking back-to-back actions. The licenses of three banks have been canceled this week. At the same time, fine has been imposed on many banks.

RBI Action : Reserve Bank of India is continuously taking action against banks.

On September 21, it was announced that the license of Ananthashayanam Co-operative Bank Limited, Trivandrum would be cancelled. Now the Central Bank has also canceled the licenses of two other banks. Their banking business has been banned. According to RBI, if banks are allowed to continue their banking business, it will affect public interest. The names of these banks are Mallikarjuna Pattana Co-operative Bank Niamita (Maskhi, Karnataka) and National Co-operative Bank Limited (Bahraich, UP).

This is the reason

RBI said that these banks do not have sufficient capital and earning potential. Thus both these banks failed to comply with the provisions of Section 56, Section 11 (1) and Section 22 (3)(D) of the Banking Regulation Act 1949. Not only this, this bank is also unable to make full payments to its current depositors with its financial condition. The Central Bank has also termed these as harmful for the interests of depositors.

Ban on banking business, customers will be affected

The Reserve Bank has banned the banking business of Mallikarjun Pattana Co-operative Bank Niamita and National Co-operative Bank Limited from September 22. These also include acceptance of deposits and repayment of deposits. Under the Deposit Insurance and Credit Guarantee Corporation (DICGC) regulations, each depositor will be entitled to claim his deposits up to Rs 5 lakh.