Even though the government extended the last date for filing the income tax returns, the website is charging fine from the tax payers.

The fine is levied based on section 234F of the Income Tax Act. As per the section 234F, tax payers must pay a penalty for delay in filing Income Tax Returns.

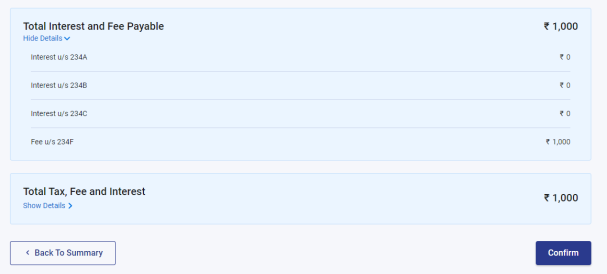

A user from Kozhikode was asked to pay Rs. 1,000 on Sunday.

The date was extended to September 30 from July 31 in May itself as a “relief during the pandemic.”

The late payment is charged with Rs. 5,000 till December 31 and Rs. 10,000 after that. If the income is less than 5 lakh, the fine is Rs. 1,000.