Finance Minister Nirmala Sitharaman will present the budget in Parliament on 1 February. This will be the last budget of the government before the Lok Sabha elections. It is an election year, so this year the government will present an interim budget, in such a situation it is expected that this budget will not give much good news.

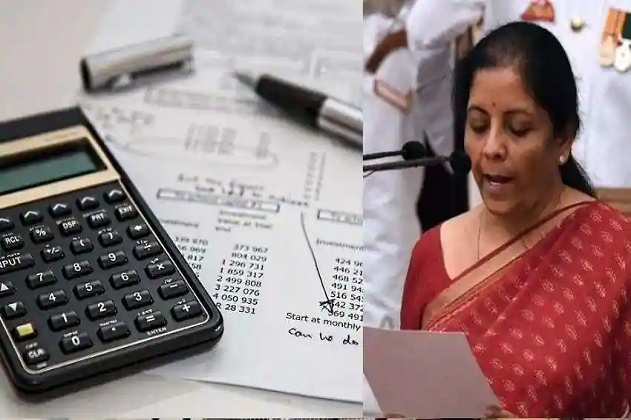

Budget 2024 expectation: Finance Minister Nirmala Sitharaman will present the budget in Parliament on 1 February. This will be the last budget of the government before the Lok Sabha elections. It is an election year, so this year the government will present an interim budget, in such a situation it is expected that this budget will not give much good news. However, the government can definitely try to tap the big vote bank through the interim budget. According to experts, the government will not make any major announcements in the interim budget, although every sector has placed expectations from the Finance Minister. The largest taxpayers in the country are the salary class and they also have a lot of expectations from this budget.

The biggest charioteer of India’s fast-paced economy is the salary class. They have a special role in the country’s economy. In such a situation, they also have special expectations from the budget. The working people who are facing huge pain of tax have five expectations from this budget.

What are the expectations of employed people?

- Stuck between the old and new regime of tax, the salaried class wants to get out of this confusion. Employed people have expectations that the government should keep one slab for the tax system.

- Employed people are hopeful that the government will make an announcement in this budget regarding increasing the limit of PPF as well as increasing its interest rates.

- Taxpayers hoping for relief regarding tax exemption are hopeful that the limit of deductions under Section 80C and 80D will be increased.

- In this budget, the government should focus on increasing the standard deduction of tax. Employed people are hopeful that the Finance Minister will increase the standard deduction from Rs 50 thousand to Rs 90 thousand.

- Employed people want the Finance Minister to rationalize the tax slabs, so that the tax burden on them can be reduced.

However, if experts are to be believed, the government is not in favor of taking any major decision regarding tax in this budget. There is very little possibility that the Finance Minister will make any major announcement regarding tax in this budget.