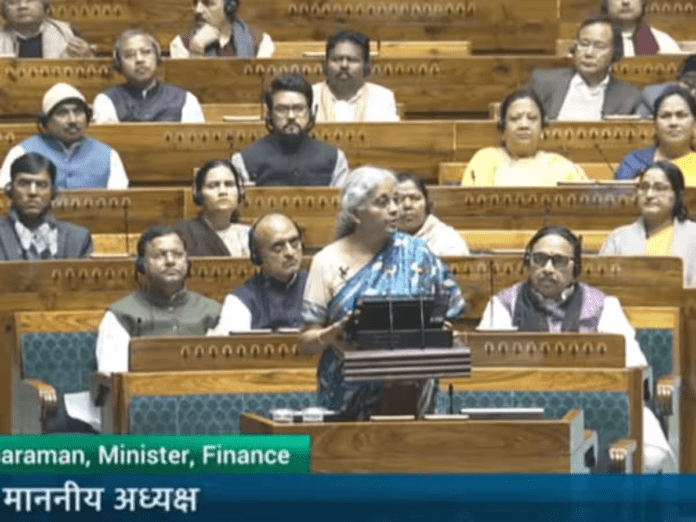

Budget 2024: The full budget for the financial year 2024-25 will be presented on July 23. Finance Minister Nirmala Sitharaman is going to present the Union Budget once again. This time the employed people have a lot of expectations from the budget.

Budget 2024: On July 23, Finance Minister Nirmala Sitharaman is going to present the full budget of 2024. This time people have high expectations from taxes. The impact of the election results can be seen in the form of announcements in the budget. People of every section have some expectations from the budget.

Changes in tax slabs, changes in deduction limit under 80C, changes in standard deduction and changes in HRA are expected. Let us try to know about these in some detail.

Changes in tax slabs

Salaried people are hopeful that some changes can be made in the tax slabs this time. Apart from this, the maximum tax in the new tax system is 25%, which the government can also implement for the old system.

Limit under 80C

At present, the limit of tax deduction under Section 80C of Income Tax is Rs 1.5 lakh. There has been no change in this after 2014-15. It is also expected to be increased to Rs 2 lakh.

Standard Deduction

Currently, a standard deduction of Rs 50,000 is available on taxable salary. Before 2019, it was only Rs 40,000. This time an increase is also being estimated in this. It is expected that the standard deduction will be increased to Rs 1 lakh.

Standard Deduction

At present, a standard deduction of Rs 50,000 is available on taxable salary. Before 2019, it was only Rs 40,000. This time an increase is also being estimated in this. It is expected that the standard deduction will be increased to Rs 1 lakh.

HRA

House Rent Allowance i.e. HRA gets tax exemption according to different cities. This time some more cities are expected to be included in the 50 percent exemption category. Let us tell you that the calculation of HRA depends on the actual rent paid, basic salary and location of the house.