Car Buying Tips: Many times people buy a car which is more expensive than their budget after seeing attractive features, later when they have to pay huge EMI every month, then their household budget gets disturbed. Know how expensive a car you should buy as per your income.

Buying a car was once a big deal, but nowadays it has become a part of necessity. Now, whether commuting within the city or traveling out of station, people prefer to travel in their own car instead of public transport. This is the reason why now every range of cars is available in the market with all the best features. In such a situation, many times people buy an expensive car from their budget after seeing the attractive car.

For this, at that time, in enthusiasm, they take a good loan amount from the bank, but later when they have to pay huge EMI every month, then their budget gets derailed. If you want that no such problem should arise with you, then fulfill the requirement of the car according to your income. Know here the special formula of 50/20/4/10, through this you can easily know how expensive a car you should buy according to your annual income. Understand this formula here-

The car should be worth half the annual income.

Here 50 means 50 percent of your annual income. Whenever you go to buy a car, decide in advance that your car should cost only half your annual income. Suppose your annual package is Rs 12 lakh, then you should buy a car only up to Rs 6 lakh. Due to this, your budget may get shaken if you buy an expensive car.

Understand the meaning of 20/4/10

In this formula, 20 means 20 percent down payment. Meaning, if you are going to buy a car worth Rs 6 lakh, then in any case give 20 percent of Rs 6 lakh i.e. Rs 1,20,000 as down payment. If you can give more than this then it is good, but do not give less. Here 4 means the tenure of the loan i.e. the tenure of your car loan should not be more than 4 years. Whereas 10 means that your EMI amount should not be more than 10 percent of the annual salary.

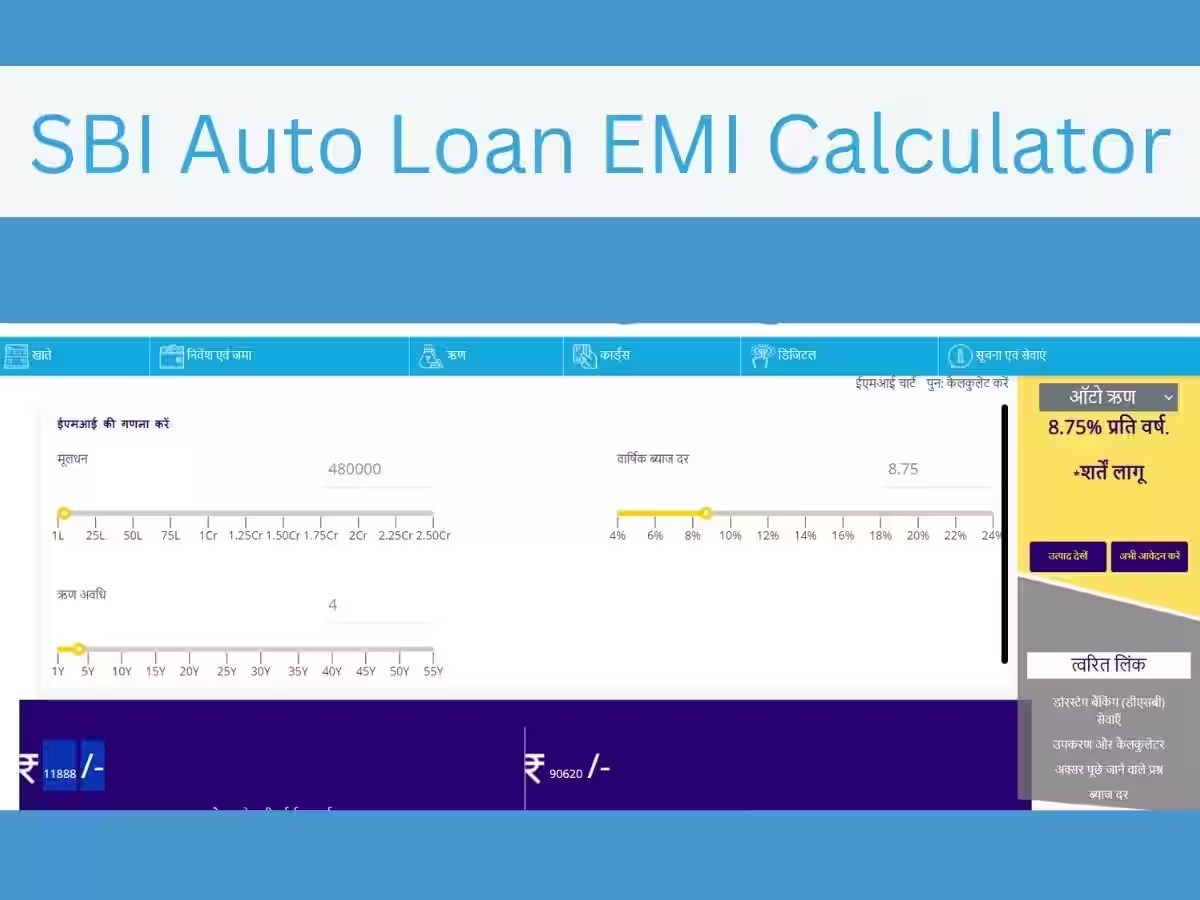

How much EMI on Rs 4,80,000?

Suppose you are going to buy a car worth Rs 6 lakh, out of which you make a down payment of Rs 1,20,000 at the rate of 20 percent. In such a situation, you will have to take an amount of Rs 4,80,000 as loan. Suppose you take an auto loan from SBI. According to SBI calculator, interest on loan of Rs 4,80,000 will be 8.75%. In such a situation, you will have to pay Rs 11,888 as EMI every month.