Bank of Baroda New Rules: Bank of Baroda has changed some of its rules. If you are a customer of Bank of Baroda, then this news can be of use to you.

Because, from the coming February 1, the new rules are going to be implemented. If you are not aware of the new rules, then there may be trouble in the functioning of the bank.

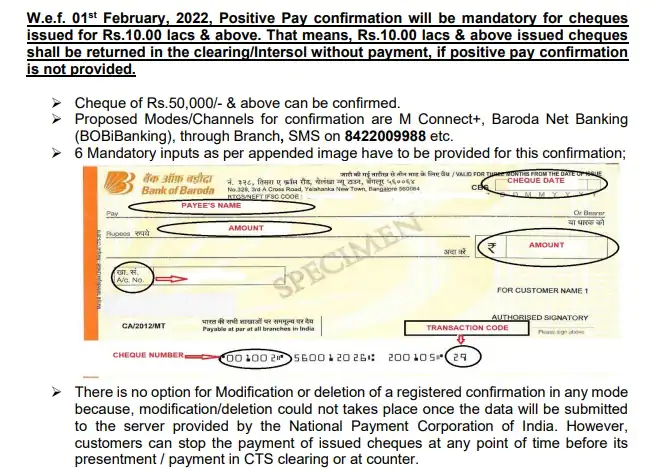

Bank of Baroda’s rules related to cheque clearance (Positive Pay Confirmation) will change from February 1. According to the new rules of the bank, confirmation will be mandatory for cheque payment from February 1. If there is no confirmation, then the cheque can also be returned. These rules will apply to cheques of an amount of 10 lakhs or more.

Bank’s appeal

The bank has appealed to the customers – you should take advantage of the facility of positive pay for CTS clearing. The bank has done this rule to avoid fraud in cheques. The bank has said to protect yourself from fraud by re-verifying the details through various channels.

Bank of Baroda has given the facility of virtual mobile number 8422009988 for positive pay confirmation. After writing CPPS, confirmation can be made by sending it to 8422009988 with account number, cheque number, cheque date, cheque account, transaction code, name of the payee. Apart from this, toll free numbers can be called on 1800 258 4455 and 1800 102 4455.

For more information about the new rule, you can click on the Bank of Baroda link.

What is cheque positive pay system

From time to time, new security measures are taken by the Reserve Bank of India to prevent the incidents of fraud related to the bank. A new system was introduced to prevent the incidents of counterfeiting through bank cheques. The new system is Positive Pay System for cheque(Positive Pay Confirmation). It was implemented in the country from January 1. Many banks have made this system effective.

Full details have to be given to the bank

When anyone issues a cheque under the positive pay system, he will have to give full details to his bank. In this, the issuer of the cheque electronically through SMS, internet banking, ATM or mobile banking, the date of the cheque, in whose name the cheque has been issued, the bank account number, the amount of the cheque and other necessary information will be given to the bank. With this system, where the payment by cheque will be safe, the clearance will also take less time.

The cheque issuer can provide all these information through electronic means like SMS, mobile app, internet banking or ATM. These details will be cross-checked before cheque payment. If any discrepancy is found in it, the bank will reject that cheque.