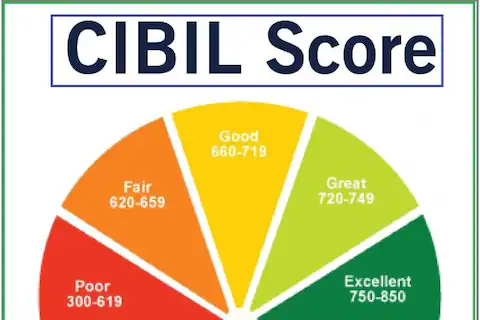

CIBIL Score: Credit score is important while taking a loan. If your credit score is low, then you will get the loan at a higher rate or you will not get it. Come, let’s understand how to improve it.

If your credit record is not good then it may be difficult for you to get a loan or credit card. On the other hand, lack of correct information on complex financial matters can also put you in these difficulties. Even though CIBIL Score seems to be a simple term, about which we often hear at the time of taking a loan. But people have very little knowledge about its importance and need. It should be clearly known about how the CIBIL score works. Also, there is a need to regularly monitor your credit report. Often the slightest wrong information provided to the credit bureaus can lower your score.

Let us understand how the CIBIL score is calculated

Mahesh Shukla, CEO and co-founder of Pemi, says that Credit Information Bureau (India) Limited (CIBIL) is a credit rating firm which has more than 2400 members. These include many institutions like financial institutions, NBFCs, banks and home financing businesses. It manages the credit history of more than 55 crore customers and companies. Although CIBIL does not tell whether a financial institution will approve your loan or credit card or not.

Actually, it tells about the old history of the person or institution taking the loan, on the basis of which the financial institutions take their decision to give the loan. CIBIL score plays an important role in the loan process. If this is good, then the chances of getting the loan will increase. On the other hand, getting a loan becomes difficult when the CIBIL Score is low. Most of the banks or finance companies even refuse to give loans. With a good CIBIL score, there is also a possibility of getting a loan at a lower interest rate. But if it is low, the interest rates can be charged much more than normal.

Certain habits related to spending, debt repayment and credit card usage have a significant impact on CIBIL. Mahesh Shukla has given some measures through which you can improve your CIBIL score-

Repay bills and loans on time: After taking a loan, always make sure that credit card bills, loan EMIs and other loans are repaid on or before the due date. Payment not made on time can have a negative impact on the CIBIL score.

Limit credit card usage: One of the most important ways to improve your credit score is by not using your credit card to its full limit. Ensuring that only 30 per cent of the credit limit is spent can go a long way in improving the credit score. Actually spending more than 30 percent through credit card shows that you increase your expenses without thinking. This will reduce your score.

Avoid multiple credit applications: Applying for multiple credit cards or loans at short intervals can land you in trouble. Doing so can create a wrong impression about the borrower that he is too credit hungry. Even this can reduce your CIBIL score. The person taking the loan should always apply for the card or loan on the basis of need.

Keep Checking Credit Report: Checking your CIBIL score or report will save you from any bad rating due to any mistake in your documents or any other problem. Because sometimes some mistakes happen while updating your records. If there is any such mistake then you can report them to the credit bureau and get them rectified immediately.

Multiple types of loans: Choose carefully between availing multiple types of loans such as credit cards, loans and mortgage loans. This can have a positive impact on the CIBIL score. However, taking more loans should be avoided.

Not closing old credit accounts: How old your credit history is matters a lot. Hence it is generally advised not to close old credit card accounts even if they are not in use. These reflect your long credit history.

Be careful while becoming a guarantor: Always be careful before agreeing to be a guarantor or co-signer of someone’s loan. The guarantor is equally responsible for timely payments and any default on the loan can affect your CIBIL score. That’s why it is advised that you take this risk only for those people whom you trust very well.

Do not make frequent inquiries for credit related information: Excessive credit inquiries can indicate financial instability. Avoid doing this. Inquire only when necessary.

Stable job and your home: Lenders consider stability in employment and residence as a positive factor. Hence borrowers should try to maintain consistency in these areas to improve their creditworthiness.

Be patient: building a good credit history takes time! Keep meeting your financial responsibilities on time. CIBIL score will improve gradually.

Shukla says that before applying for a loan or credit card, borrowers must remember that their CIBIL score is just one aspect of their financial health. To improve your financial condition, manage your finances wisely. For this, it is also necessary to save, invest and budget effectively.