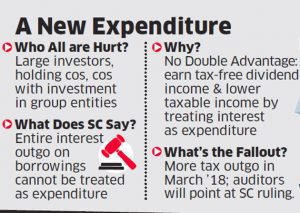

MUMBAI: Holding companies of many Indian business houses, corporates investing in subsidiaries and associates, as well as several large individual investors will have to cough up more tax after a Supreme Court ruling last week.

The verdict, which attempts to close a few contentious issues that have been hanging for nearly two decades, will prevent many companies and investors from treating their entire outgo of interest on borrowings as ‘expenditure’. This will be applicable to almost all holding entities and several corporates earning dividend from subsidiaries and group companies.

The apex court has partly upheld the tax department’s view that investors – be it companies or individuals – cannot take double advantage: first, avoid tax on exempt income like dividend (and, till recently long term capital gains) as well as lower taxable income by treating the interest on loans taken (presumably, for such investments) as expenditure.

Rejecting the argument that holding companies typically invest in subsidiaries, the court has viewed that once there is exempt income (such as dividend), the motive and intention of investment should be ignored. Even when shares held are treated as ‘stock in trade’ and not ‘investment’, the assessee, according to the recent ruling, should be disallowed from treating a slice of the loan interest as expenditure.

Here, the extent of interest amount should be calculated on a pro-rata basis: consider, a firm or an individual who borrows Rs 5 crore to buy stocks; pays an interest of Rs 50 lakh (at 10%), earns dividend of Rs 5 lakh, and then sells the shares after some months to make a gain of Rs 35 lakh; of his total income of Rs 40 lakh, there is tax on Rs 35 lakh which is treated as ‘business income’ while Rs 5 lakh – or, 11.2% of total income – is exempt from tax; therefore, 11.2% of the interest amount (of Rs 50 lakh) should be disallowed as expenditure in calculating the income tax.

“Still, there are issues that are open and untouched by the verdict. What if a company does not receive dividend in a particular year? Will it still be disallowed from treating the full interest amount as expenditure in that particular financial year? In case of shares held as stock in trade and in case of multi-product companies, the challenge will be to identify the portion of interest amount that should be considered for apportionment,” said senior chartered accountant Dilip Lakhani.

The ruling will not only impact the fourth quarter earnings of many companies, it would compel them to crystallise tax outgo on old disputes which till now were considered as “contingent liability” in balance-sheets. Chances are most auditors would insist on this before signing the accounts for the year ended 31 March 2018. “The ‘dominant intention test’ – i.e. the purpose of making investment in shares to gain ‘controlling interest etc – has been overruled by the SC which has given a plain and intentional interpretation to section 14A (of the IT Act),” said Sanjay Sanghvi, Partner at law firm Khaitan & Co.

Last week’s court verdict – relating to a dispute between Maxopp Investment and the tax department – follows many twists and turns and multiple high court rulings on the subject over the years.

TWIST & TURNS

It all began with a Supreme Court judgement that allowed any interest expenditure incurred in the course of business irrespective of whether the income earned was exempt from tax. Responding to this the government changed the law to disallow interest expenditure corresponding to exempt income. However, companies, advised by sharp accountants, dodged the law by maintaining a time gap between borrowing and investments and using the intervening period to spend on other heads such as salaries, travel, etc. This was done to break a direct connection between borrowing and investments (in stocks) that are capable of generating tax-free income (like dividend).

In 2008, the tax office tried to plug the loophole by inserting a new rule. According to a flat formula that was introduced, the extent of interest expenditure that was to be disallowed was determined by the percentage of investments that can generate tax-exempt income to total assets. So if a company has total investment of Rs 2,000 crore in listed stocks and total assets of Rs 10,000 crore, then 20% of the interest outgo on borrowings would be disallowed as expenditure. More legal battles followed. In two cases, there were High court rulings that went in favour of the companies because their net worth was higher than the investments – enabling them to argue that investments were made with the own funds of the companies and not with borrowed money.

In another case, the High court accepted the company’s view when it argued that since government rules on auctions and participation in infrastructure and other projects required formation of separate companies, investment in these companies for project implementation should not deprive the parent company from claiming interest on borrowings as expenditure.

However, the recent Supreme Court ruling has gone against India Inc on two counts: first, interest cannot be treated as expenditure even if the intention of the holding company or parent was to maintain control; second, a part of interest, calculated on a pro-rata basis, would be disallowed even if shares are held as ‘stock in trade’ and not investments.