In today’s time, the use of credit cards has increased a lot. From cities to villages, people have started using credit cards. However, there are very few people who understand the true meaning of all the numbers written on the credit card. At the same time, only a few people know the meaning of the 16 digit number of the card. Let us understand what each number means.

The first digit gives important information

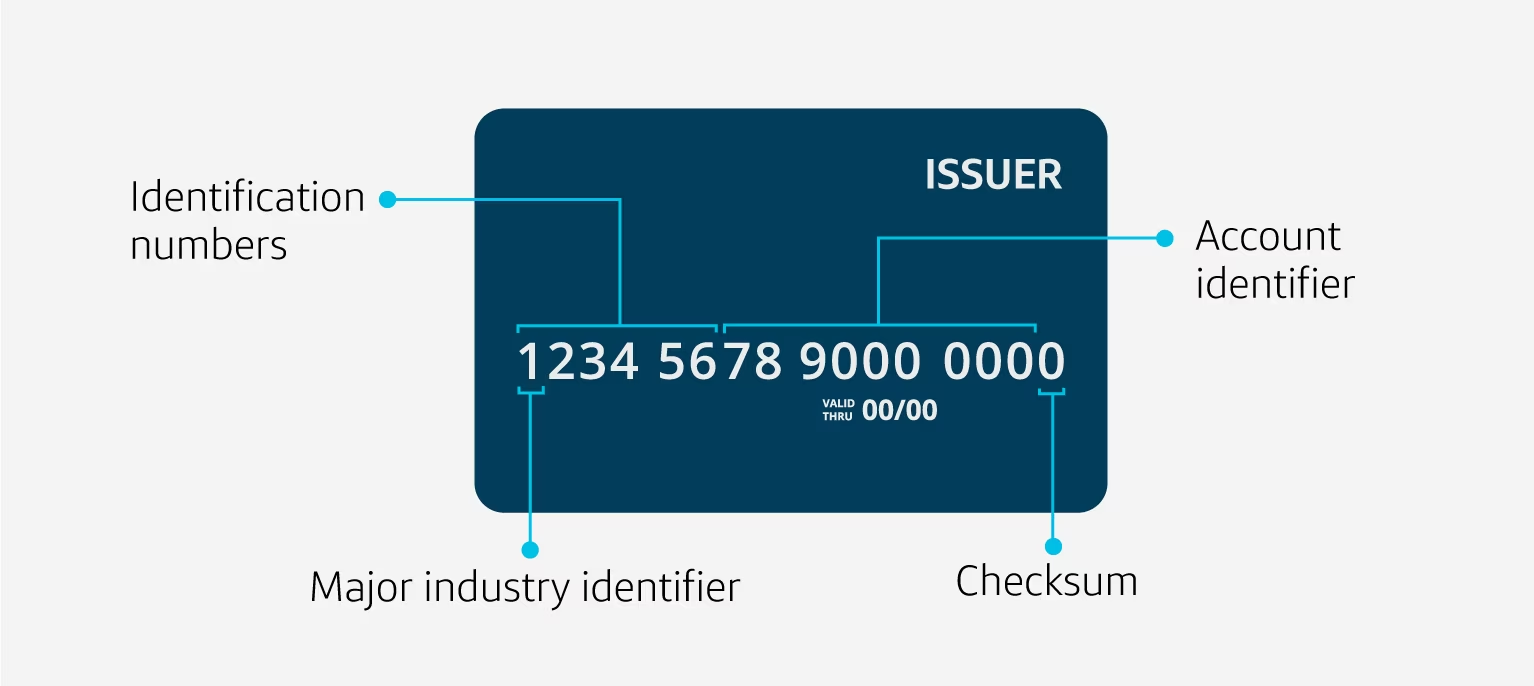

As soon as you see the first number of the credit card, you can understand which card company i.e. Major Industry Identifier (MII) has issued it. If your credit card is from Visa, its number will be starting with 4. If it is issued by Mastercard, it will be starting with the number 5. Whereas if your credit card is Rupay card, then its first digit will be 6.

First 6 digits together represent IIN

The first 6 digits of the number written on any credit card tell you what the issuer identification number (IIN) of your card is. In many places it is also called Bank Identification Number i.e. BIN. This number shows which bank or financial institution has issued the credit card.

The next 9 digits indicate the account number.

The next 9 digits of the credit card i.e. from 7th to 15th digit tell what is your credit card account number. This account is in the bank or financial institution from which you have taken the credit card.

The last digit is ‘check digit’

The last digit of the credit card is called check digit. This validates the entire credit card number. Through this number, banks ensure that fraudsters are not able to issue fake credit cards.

Expiry date

Apart from the 16 digits written on the card, there is also an expiry date written on it. It tells when the card has been issued and how long it will remain valid. In some cards, only validity is written, the date of issue of the card is not mentioned. Information about the month and year is written on the card, but the date is not written. In such a situation, it is assumed that the date of issue is 1st and the date of validity is 30th/31st or whatever is the last date of the month.

CVV number

A 3 digit card verification number i.e. CVV number is written on the back of every credit card. It is sometimes also called card verification code i.e. CVC number. This number is written at the end of the signature strip on the back of the card. In some cases this may also be written on the front of the card. This number acts as a separate layer of authentication. This is the reason why whenever you do any online transaction through credit card, you have to enter the CVV number there also.

Also Read-

- Post Office Monthly Income Scheme: How is your monthly income taxed, check rules and benefits

- Why do banks charge Loan Prepayment Penalty? How to calculate whether it is right to repay the loan prematurely or not?

- Gold Vs Silver Price: Silver can reach Rs 92000 in 3 months, know why are prices increasing?