Diwali Bonus: Only those employees who were in service as on 31.3.2023 and who have rendered at least six months of continuous service during the year 2022-23 will be eligible for payment under these orders. Pro-rata payment will be admissible to eligible employees for a period of continuous service during the year ranging from six months to a full year.

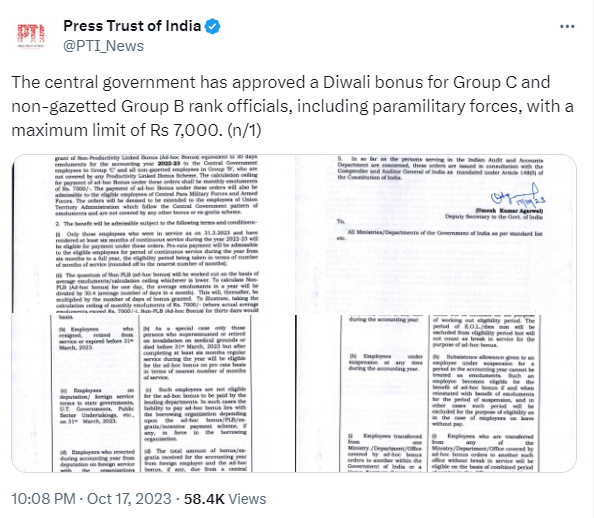

The government has approved non-productivity linked bonus i.e. adhoc bonus to central employees. The central government led by PM Narendra Modi has also put certain conditions while announcing the bonus before Diwali for Group C and non-gazetted Group B rank officers, including paramilitary forces. The Finance Ministry has set a limit of Rs 7000 for calculating non-productivity linked bonus (ad-hoc bonus) for central government employees for 2022-23.

The Department of Expenditure under the Finance Ministry said in an office memorandum that non-productivity based bonus (NPL) equivalent to 30 days’ emoluments will be granted to Group C employees and all Group B non-gazetted employees of the central government for the accounting year 2022-23. Ad-hoc Bonus) is given, which are not covered under any productivity linked bonus scheme.

The Center has laid down certain conditions for the distribution of this bonus, as follows-

- Only those employees who were in service as on 31.3.2023 and who have rendered at least six months of continuous service during the year 2022-23, will be eligible for this bonus. Will be eligible for payment under the orders. Pro-rata payment will be admissible to eligible employees for a period of continuous service during the year ranging from six months to a full year.

- The quantum of Non-PLB (Ad-hoc Bonus) will be determined on the basis of average emoluments/calculation limit, whichever is lower. To calculate non-PLB (ad-hoc bonus) for a day, the average emoluments in a year will be divided by 30.4 (average number of days in a month). After this, it will be multiplied by the number of days of bonus given. For example, the calculation limit of ₹7000 (where actual average emoluments are more than ₹7000) taking non-PLB (Ad-hoc Bonus) for thirty days would be ₹7000×30/30.4- ₹6907.89 (up to ₹6908).

- Casual workers who have worked for 6 years or more for at least 240 days each year for 3 years or more will be eligible for this Non-PLB (Ad-hoc Bonus) payment. The amount of Non-PLB (Ad-hoc Bonus) payable will be (Rs. 1200×30/30.4 i.e. Rs. 1184.21/-). In cases where the actual emoluments are less than Rs. 1200/- per month, the amount will be calculated based on the actual monthly emoluments. But it will be done.

- All payments under these orders will be made to the nearest rupee

- The notification states that the expenditure on this item will be debited in the relevant item item as per the notification of the Department of Expenditure dated December 16, 2022.

- As per the Government, the expenditure on account of this ad-hoc bonus is to be met from within the sanctioned budget provision of the concerned Ministries/Departments for the current year.