This new 5G chunk is separate from the Rs 5.22 lakh crore spectrum sale plan approved by the Digital Communications Commission on December 20, under which 8,300 MHz of airwaves across 22 circles are set to be put on block in March-April 2020.

NEW DELHI|KOLKATA: The telecom department will shortly urge the sector regulator to clear the way for auctioning the coveted spectrum in the 26 GHz band, aiming to reduce 5G deployment costs and, therefore, allow affordable ultra-fast mobile broadband services.

The Department of Telecommunications (DoT) will seek pricing recommendations from the Telecom Regulatory Authority of India (Trai) for this band, a senior government official said. “We will be taking a Trai reference for the 24.75 to 27.25 GHz millimetre wave band (popularly known as the 26 GHz band), and look at an auction sometime later next year,” the official said on condition of anonymity.

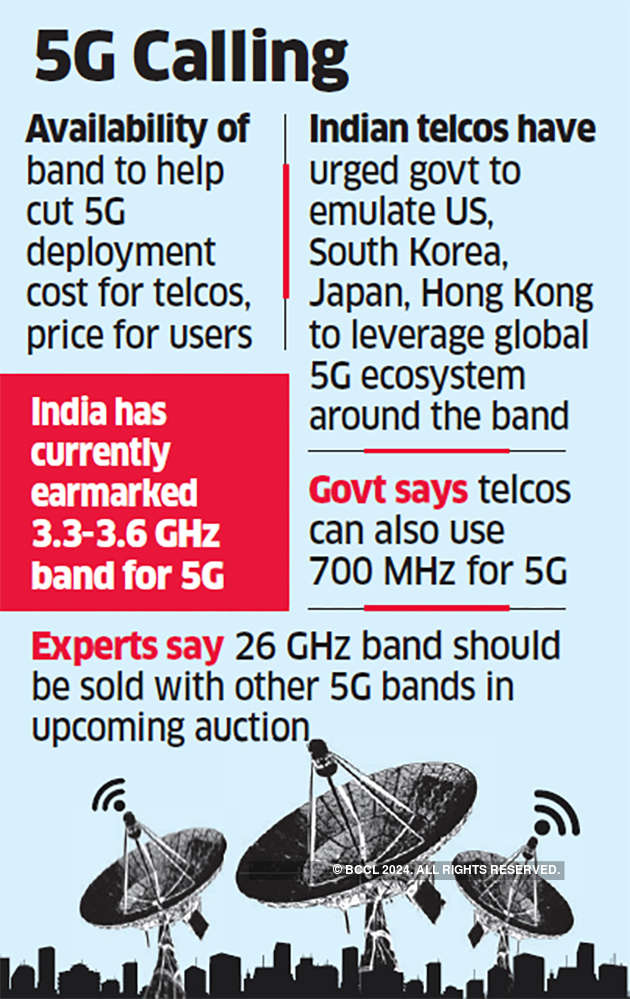

The 26 GHz band spectrum is widely seen by telecom operators worldwide as amongst the most efficient airwaves for delivery of affordable 5G services. Indian telcos have urged the government to emulate the US, South Korea, Japan and Hong Kong to leverage the global 5G ecosystem developing around the 26 GHz band. These airwaves are also ideal for industrial applications.

But government insiders hinted that 26 GHz band spectrum is unlikely to be auctioned in the upcoming sale since the approval process and price discovery mechanism may take more time.

For now, DoT has only earmarked spectrum in the 3.3-3.6 GHz band for 5G services. But experts believe the government and Trai have enough time to set a starting price for 26 GHz spectrum since the International Telecom Union (ITU) recently finalised rules around global 5G deployments on this wave band at the World Radio Conference-2019 in Egypt. “There’s no economic logic in conducting two separate 5G auctions in 2020. Since ITU has ratified the 26 GHz band for 5G globally, there is nothing stopping the government from asking Trai to quickly fix an appropriate reserve price for these airwaves to include them in the upcoming sale by April next year,” said a top industry executive specialising in spectrum regulation and management.

Backing the view, Com First (India) director Mahesh Uppal said, “It’s in the government’s interest that mobile operators get adequate, quality spectrum in the 26 GHz band and are not forced to lock their funds instead in 3.5 GHz airwaves.”

Earlier this month, the Cellular Operators Association of India (COAI) — which represents Bharti Airtel, Reliance Jio and Vodafone Idea — asked telecom secretary Anshu Prakash to push Trai to include 26 GHz in the list of 5G airwave bands earmarked for the upcoming sale.

Telcos had also said any reservation of 26 GHz band spectrum for government agencies such as Indian Space Research Organisation (Isro) would adversely impact 5G deployments in India, going forward. They had suggested that future satellite deployments by Isro should be done in other frequency bands.

Last week, the Digital Communications Commission (DCC), the highest decision-making body in the DoT, cleared the country’s largestever spectrum auction likely around March-April 2020 that can potentially fetch the government over Rs 5 lakh crore if the carriers bid for the whopping 8,300 units of 4G and 5G airwaves on offer.

But analysts ruled out the possibility, citing a combination of high reserve prices, incumbents’ stretched balance sheets, the absence of India-relevant 5G use cases and an immature device ecosystem.