Covid-19 has accelerated insurance awareness in India. The findings of this Policybazaar survey show that unlike in the past, insurance has now become a product that consumers are likely to buy without the need for a big sales push.

There is a lot of bad news surrounding the novel coronavirus. However, there is one good thing that has happened due to the pandemic. More and more people are now becoming aware of the importance of having insurance — be it health or life insurance.

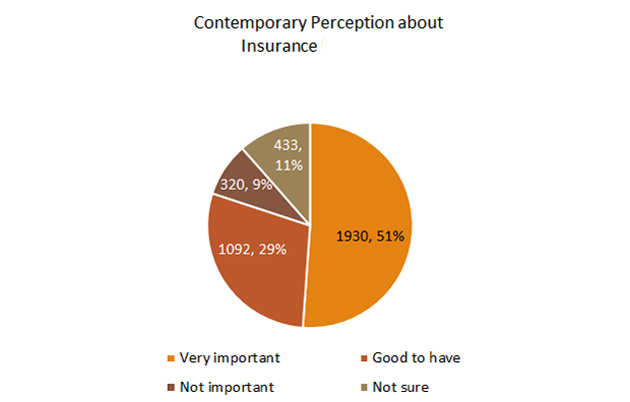

A recent study by Policybazaar.com found that about 51 per cent of the respondents said that having an insurance cover is important while nearly 80 per cent said they were aware of the benefits of insurance especially during a pandemic.

“Even though people seem well in control of their financial health and matters, they are extremely worried about the risk to their and family’s physical health. As a result, the perception of the importance of health and life insurance is now higher than ever,” Policybazaar.com stated in a press release.

The online study was conducted to understand consumer sentiment towards household finances, investments and insurance during the Covid-19 pandemic. For the study, 14,624 Policybazaar.com users were surveyed.

The survey found that unlike in the past, insurance has now become a product that consumers are likely to buy without the need for a big sales push.

Sarbvir Singh, CEO, Policybazaar.com, said, “During times like these, it is important to understand people’s outlook towards personal finances, investment and spending. This study clearly points towards both term life and health insurance starting to become a cornerstone of personal financial planning in times of the Covid-19. The pandemic has definitely accelerated awareness about insurance in India where insurance penetration remains low even today.”

Over half of the visitors of the insurance portal’s website and app considered having insurance as very important and only 11 per cent did not consider it important even in the wake of Covid-19.

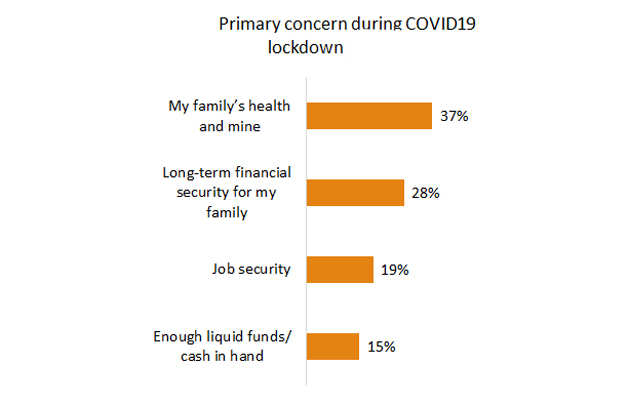

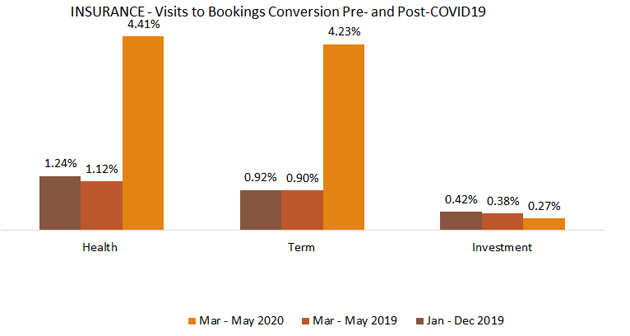

Health insurance purchases doubled between March and May this year compared to the same period in 2019. Personal and family’s health, as expected, was the biggest concern for nearly 37 per cent respondents.

Also Read: Applying for Credit Card? These SBI Card benefits can be useful for you

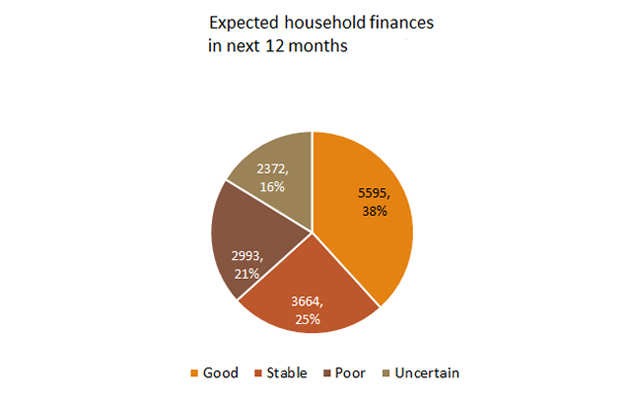

Coming to household finances and the income-expenditure aspect, nearly two in three respondents were confident of their household expenses remaining stable and manageable over the next 12 months. About 15 per cent said they were worried about a cash crunch. On the job security front, 19 per cent respondents indicated any sort of anxiety about retaining their employment.

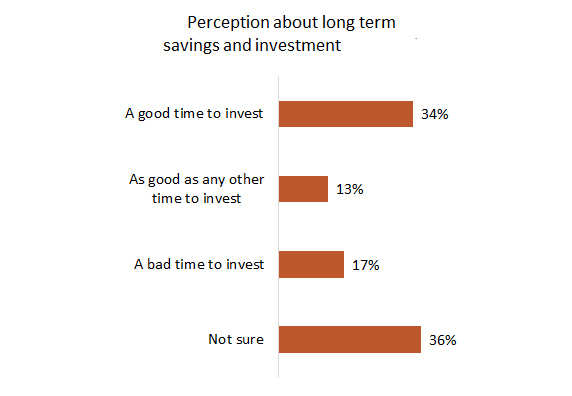

To understand people’s attitude towards long-term savings and investments during this period of uncertainty, respondents were asked about their intention to invest via various market instruments. Nearly 47 per cent felt this was a good time to invest to earn good returns. “This indicates increased investment literacy among Indians as usually, the stock market’s rebound strongly after a fall during the times of a widespread health crisis or pandemic,” Policybazaar.com stated.

Despite the current unstable market and economic conditions, 63 per cent of the respondents expect financial stability in the short term (next 12 months), however, long-term stability was a concern for 28 per cent.