EPF Calculation: Experts say that if there is no great need then the amount deposited in PF account should not be withdrawn before retirement. However, if needed, you can withdraw money from your PF account at least after completing 7 years of service.

PF Calculator: Retirement is a very important topic for any working person. Even though you are still young, if you understand the intricacies of retirement now or include it in your financial planning, then you will be financially comfortable after retirement. When you are working, you know that you have a PF account and every month a fixed amount is deposited in it from your salary. PF account (Provident fund account) is managed by the government organization EPFO. Have you ever wondered what will be the total PF amount you will get on retirement? Let us understand it here with a calculation.

Understand the calculation here

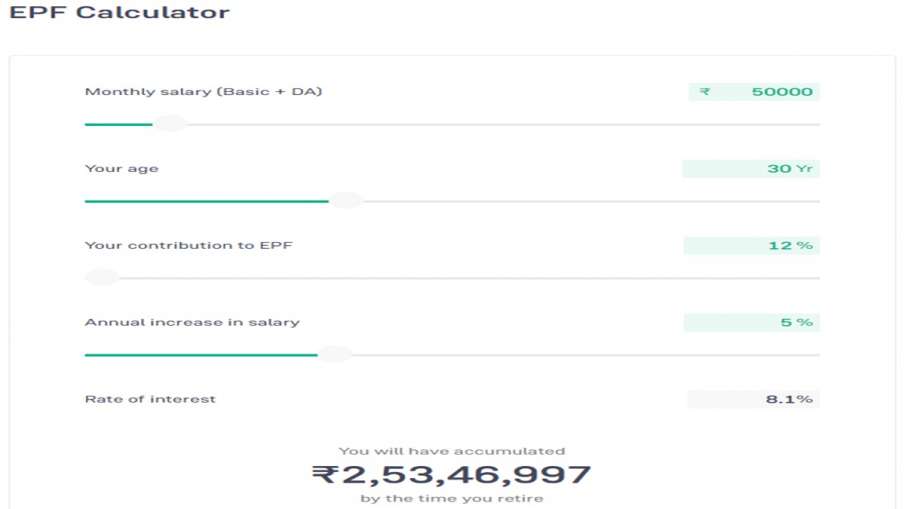

If you are currently 30 years old and are working in a job in which your salary is Rs 50,000, then on this basis we can understand from a calculation here that what will be the total PF amount you will get on retirement i.e. on completion of 60 years. Suppose you are 30 years old and get a salary of Rs 50 thousand. You have to contribute 12 percent of the salary in PF account.

At present 8.1 percent interest rate is applicable on the amount deposited in PF account. After this, if your salary increases by at least 5 percent every year, then according to Groww’s EPF Calculator, you will get a total of Rs 2,53,46,997 on retirement (pf money after retirement). That means you will get an amount of more than Rs 2.50 crore. This is a rough calculation. Actual figure may vary.

Avoid withdrawing money from PF account

If most of the private sector employees work in the organized sector, they are entitled to get benefits after retirement. Government employees are additionally eligible for pension, unlike their private sector counterparts. Experts say that if there is no great need then the amount deposited in PF account should not be withdrawn before retirement, but at least after completing 7 years of service, you can withdraw the amount deposited in provident fund i.e. PF. You can withdraw money from. Also, money can be withdrawn only three times in the entire PF account period. Keep in mind that you cannot withdraw more than 50 percent of your contribution.