EPF Calculator: An interest of 8.1 percent is being available on the EPF deposit amount. If you do not withdraw till retirement, then no one can stop you from building a large corpus. Also, the magic of compounding interest is such that you can become a millionaire by investing till the age of 58.

EPF Calculator: Provident Fund Account is a retirement savings plan for people working in the private sector. The EPF account accounts for 24 per cent (12+12) of both the employee and the employer, including Basic Salary and Dearness Allowance. Every year the government pays interest on the amount deposited in the EPF account. It is reviewed by the Central Board of EPFO on an annual basis. At present, the interest of 8.1 percent is being available on the EPF deposit amount. If you do not withdraw till retirement, then no one can stop you from building a large corpus. Also, the magic of compounding interest is such that you can become a millionaire by investing till the age of 58. Understand how…

Double interest benefit is available on interest

Account holders generally believe that interest is earned on the entire money deposited in the provident fund. But, this does not happen. The amount that goes to the Pension Fund in the EPF account does not earn any interest. In every month’s salary slip, you can see how much is your basic salary and DA. 12 percent of the Basic Salary + DA of every employee goes to the EPF account. The company also contributes 12% of Basic Salary + DA. The money collected by combining both the funds earns interest. But, its advantage is that due to compound interest, the interest also doubles. Means you get the benefit of interest on interest.

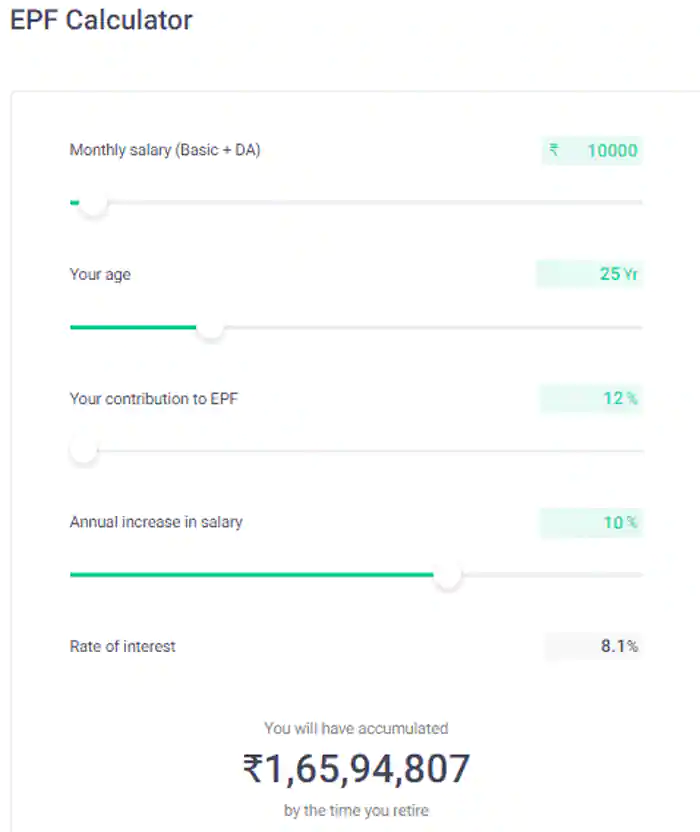

Rs 1.65 crore will be available on 10,000 basic (How to become Crorepati)

EPF member age 25 years

Retirement age 58 years

Basic salary Rs 10,000

Interest rate 8.1%

Salary increase 10% (p.a.)

Net corpus Rs 1.65 crore

Retirement Fund at 15,000 Basic Salary

EPF Member Age 25 Years

Retirement Age 58 Years

Basic Salary Rs 15000

Interest Rate 8.1%

Salary Increase 10% (Annual)

Total Fund Rs 2.59 Crore

Calculation of interest on EPF (How to Calculate Interest on EPF)

Interest is calculated on the money deposited in the EPF account every month (Monthly Running Balance). But, it is deposited at the end of the year. According to the rules of EPFO, if any amount is withdrawn in a year from the balance amount on the last date of the current financial year, then it is deducted 12 months interest. EPFO always takes the opening and closing balance of the account. To calculate this, the monthly running balance is added and multiplied by the rate of interest / 1200.

Withdrawal Impact Interest computation

If any amount is withdrawn during the current financial year, then the EPF interest calculation is taken from the beginning of the year to the month immediately preceding the withdrawal. The year’s closing balance (PF Balance) will be its opening balance + contribution-withdrawal (if any) + interest.

Think of it as

Basic Salary + Dearness Allowance (DA) = ₹30,000

Employee Contribution EPF = 12% of ₹30,000 = ₹3,600

Employer Contribution EPS (subject to limit of 1,250) = ₹1,250

Employer Contribution EPF = (₹3,600-₹1,250) = ₹2,350

Total Monthly EPF Contribution = ₹3,600 + ₹2350 = ₹5,950

Contribution to PF till April 1, 2022 (EPF Contribution till April 2022)

- Total EPF contribution in April = ₹ 5,950

- Interest on EPF in April = Nil (No interest in first month)

- EPF account balance at the end of April = ₹ 5,950

- EPF contribution in May = ₹ 5,950

- EPF account balance at the end of May = ₹ 11,900

- EPF Interest calculation for every month = 8.10%/12 = 0.00675% Interest calculation

on EPF for May = ₹ 11,900*0.00675% = Rs 80.32

What is the interest formula on Provident Fund? (EPF Interest rate formula)

The interest rate for any financial year is notified by the government. Interest calculation (EPF Interest calculation) is done at the end of the current financial year. The interest amount is calculated by adding the balance amount on the last date of every month of the year and dividing the fixed interest rate by 1200.