EPFO has not yet given interest for the last financial year. There are still some days when this interest will be credited to your EPF account. But, meanwhile a good news is waiting for you. Soon the interest rate for the current financial year (EPF Interest Rate) is to be fixed.

EPFO has not yet given interest for the last financial year. There are still some days when this interest will be credited to your EPF account. But, meanwhile a good news is waiting for you. Soon the interest rate for the current financial year (EPF Interest Rate) is to be fixed. For this, the board CBT of EPFO is going to meet in the last week of March.

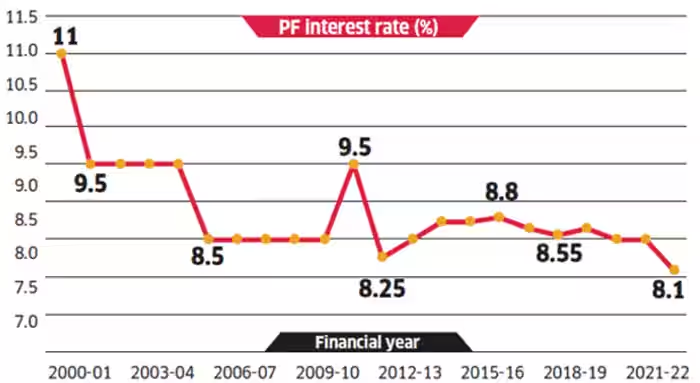

The interest rate that was fixed in the last financial year was the lowest in 40 years. It was reduced from 8.5% to 8.1%. It is being claimed in many reports that interest rates can be cut this year as well. But, sources associated with CBT believe that the interest rate will not decrease but will increase.

EPFO may increase the interest rate

The next meeting of CBT has been fixed on 25 and 26 March. In this meeting, the interest rates are to be fixed for the current financial year 2022-23. Interest rates are decided every year during the board meeting in March. Last year has been very good for EPFO in terms of earnings. Earnings have increased. Employees Provident Fund Organization invests your money in many places.

He gets a return on this. It is through this earning that you get interest on the investment. It is being claimed in many reports that EPFO can cut interest rates. but it’s not like that. There is every expectation that interest rates can be increased for the current financial year. Many reasons account for this.

How much can the interest rate increase?

First, let us know by how much the interest rate on EPF can increase. During the review of interest rates on PF, CBT sees how much he has earned in the current financial year and from where. In such a situation, the interest on PF can be reduced or increased. Last time EPFO’s earnings were good, yet the interest was reduced to 8.1%. If sources are to be believed, this time also the earning of EPFO has been good. He has got very good returns from the equity market. Therefore, there is a possibility of increasing interest rates by 10 basis points. Means the total interest can be 8.20%. However, the earnings data of EPFO is yet to come. It will be decided on the basis of this only. It is also possible that EPFO will keep the interest rates constant.

Why can the interest rate be increased?

Why can EPFO increase interest? It is necessary to raise this question. Our sources tell us that there are two aspects to this. First, the returns from equity and debt have been good. At the same time, the second is the Lok Sabha elections next year. Before that, assembly elections are also to be held in many important states. Therefore, the scope for reducing the interest rate on PF is very less. If EPFO increases the interest rates, then definitely it can be a great news for you. At the same time, there will be a possibility of crores of people getting interest money till the next Holi (2024).

Where does EPFO invest money?

Employees’ Provident Fund Organization (EPFO) invests your money deposited in provident fund accounts in many places. A part of the earnings from this investment is given to you in the form of interest. EPFO invests 85% of the total deposits in debt options. These include government securities and bonds. A total investment of Rs 36,000 crore is made in this. The remaining 15% is invested in ETFs (Nifty & Sensex). PF interest is decided on the basis of earnings from debt and equity.