Tax Calculation: If an employee contributes more than Rs 2.5 lakh in a financial year to the Provident Fund, then tax will have to be paid on the interest received on deposits above Rs 2.5 lakh.

Tax Calculation: Interest received on money above Rs 2.5 lakh deposited in EPF account is now taxable. A new rule has been notified on Provident Fund Account with effect from 1st April 2022. Meaning that from April 1, 2022, the tax will be calculated on the interest earned on the money deposited on your EPF account. Let’s understand what is the New Testament? How much and how will this affect you? How TDS will be deducted on taxable and non-taxable EPF?

New maths of tax on EPF?

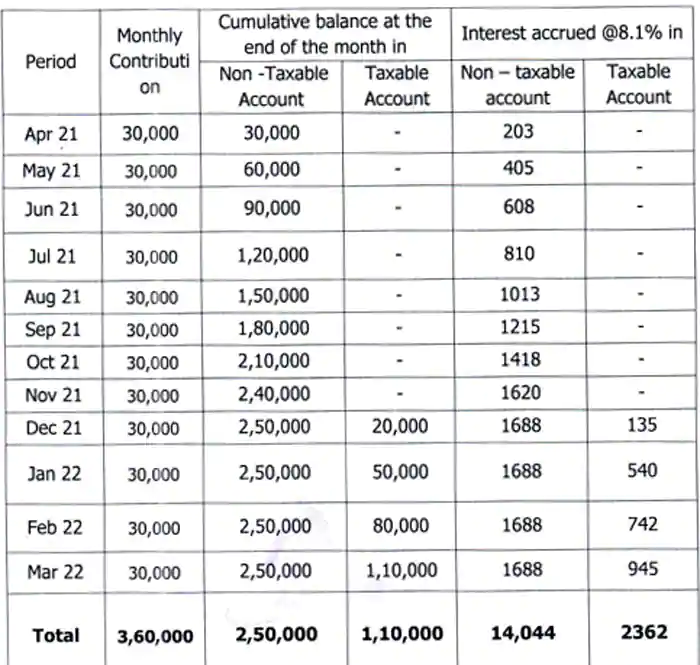

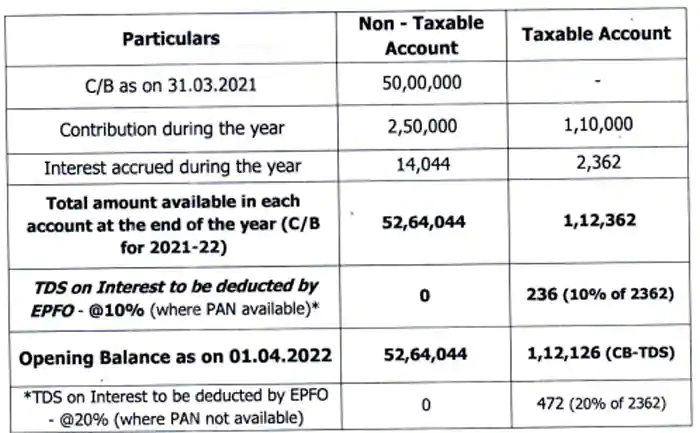

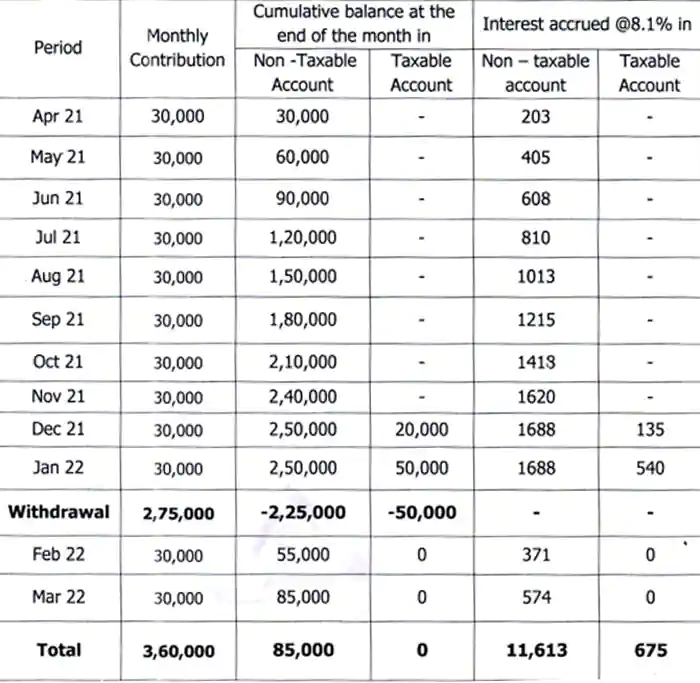

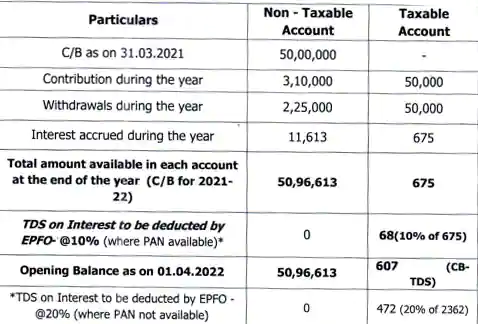

The government has taken this step because of those who take more advantage of the Provident Fund account. A new provision was added in the Finance Act 2021. If an employee contributes more than Rs 2.5 lakh in a financial year to the Provident Fund, then tax will have to be paid on the interest earned on deposits above Rs 2.5 lakh. Suppose if Rs 3 lakh is in the account, then interest earned on additional Rs 50,000 will be taxed.

Two provident fund accounts will be created

Now there will be two accounts in the Provident Fund. First- taxable account and second- non-taxable account.

- Non-taxable: Understand that if someone has Rs 5 lakh deposited in his EPF account, then under the new rule, the amount deposited till March 31, 2022 will be deposited in the account without tax. No tax will be levied on this.

- Taxable: If more than Rs 2.50 lakh is deposited in one’s EPF account in the current financial year, then the interest received on the additional amount will come under the purview of tax. The rest of the money will be deposited in the taxable account for calculation on this. Tax will be deducted on the interest earned in it.