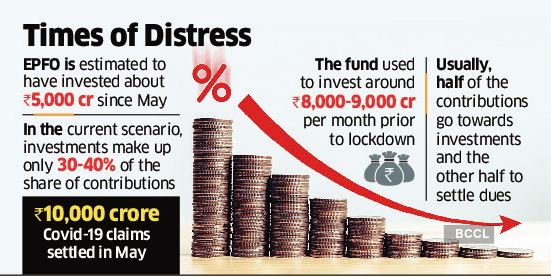

The fund is estimated to have halved its investments to about 5,000 crore since May

Mumbai: The Employees’ Provident Fund Organisation (EPFO), India’s biggest debt investor, has cut its investments in bonds and equities in the past five weeks as contributions to the corpus decline and claims rise due to the sudden disruptions in salary incomes on account of the nationwide lockdown to combat Covid-19.

The fund is estimated to have halved its investments to about 5,000 crore since May, said a senior executive involved in EPFO’s decision making. In May alone, it invested about 4,000 crore compared with an average of Rs 8,000-9,000 crore every month prior to the lockdown.

The decline in contributions is leading to equities bearing the brunt as the EPFO is turning more risk-averse with the uncertainty of second wave of infections and likely financial stress for companies.

“Majority of its investments are in bonds as it has reduced the share of equity investments,” the person told ET. The retirement body is mandated to invest up to 15 per cent of its corpus into the equity market. The share may have gone to 10 per cent amid looming economic uncertainties.

The Central Provident Fund Commissioner did not reply to ET’s queries until Thursday press time.

The reduction in investments has also cut demand for corporate bonds. Even after RBI’s 40 bps rate cut on May 22, the spread or differential between benchmark bond yields and top-rated public sector and private sector companies remains in the range of 80-90 bps as it was before the rate reductions.

“Large investor absence is felt in the corporate bond market as the demand for papers is not so significant during lockdown period,” said Ajay Manglunia, head of fixed income at JM Financial. “Once the economy comes back to normalcy, institutional debt investment is likely to resume usual investments.”

Last year, EPFO used to receive 614 crore every day from its members. Half of it was being invested and the remaining used to settle dues. The share of investment has now come down 30-40 per cent with monthly flows significantly falling. With unlocking, the scene may improve in the months ahead, said the source.

Also Read: Lockdown hits April e-payments

EPFO can invest up to 45 per cent of its corpus into corporate bonds rated not below AA by two rating companies. However, it has stopped investing in private sector bonds after its two bets including DHFL blew up. The retirement body has a total corpus of over 12 lakh crore, show lat

est data.

More than two months ago, the finance ministry relaxed EPFO withdrawal norms as it allowed people to withdraw 75 per cent of the credit standing in the provident fund account, or three months of wages, whichever is lower. In May, EPFO settled about 10,000 crore claims due to Covid-19, sources said.