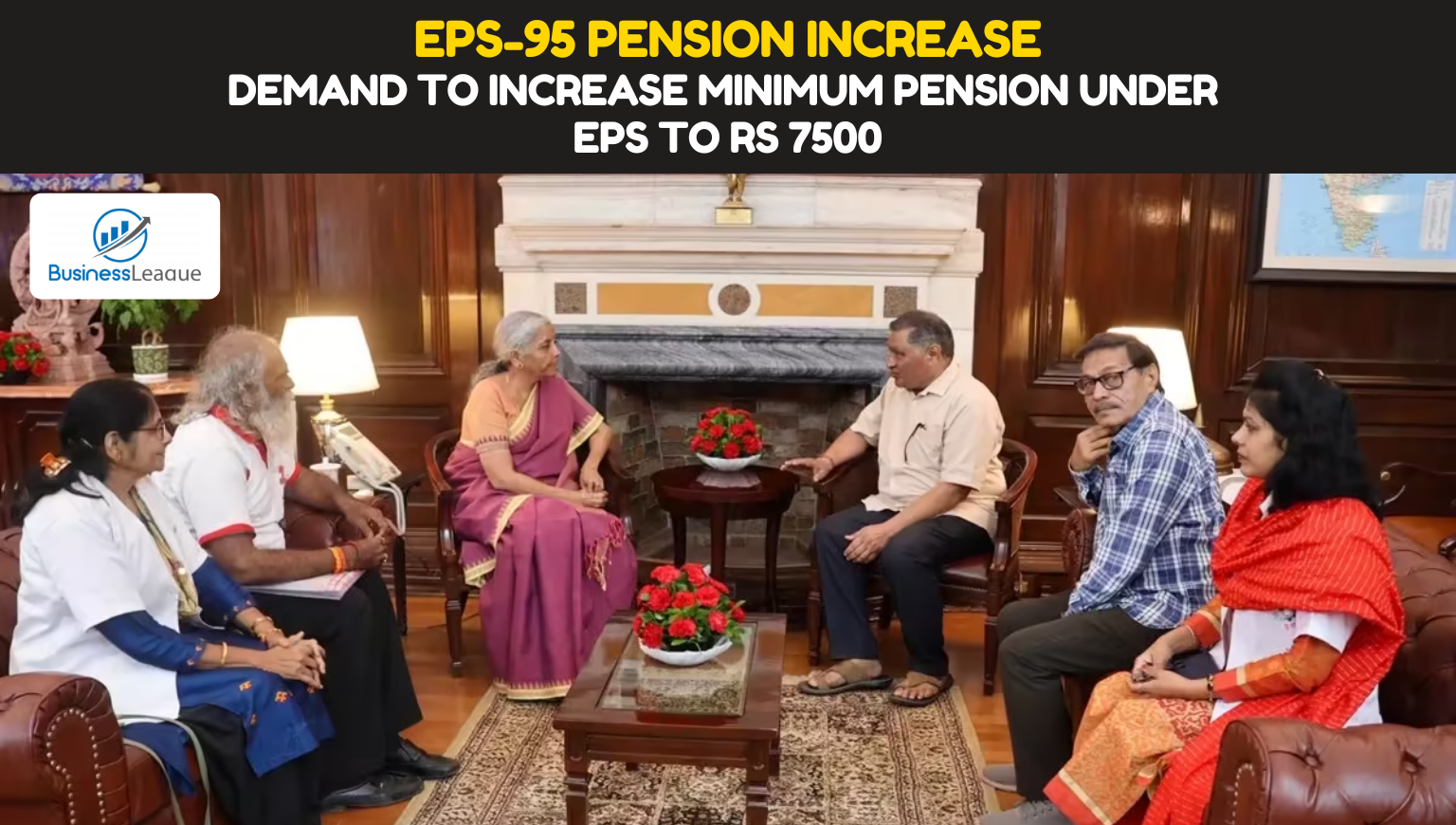

EPS-95 Pension Increase: A delegation of pensioners met Finance Minister Nirmala Sitharaman on Friday with demands including minimum pension of Rs 7500 per month with dearness allowance. After the meeting, Raut said that the Finance Minister has assured the delegation that our demands will be considered sympathetically. The government should announce a minimum pension of Rs 7500 and dearness allowance in the upcoming budget.

EPS-95 Pension Increase: A delegation of pensioners covered under the pension scheme of the Employees’ Provident Fund Organization (EPFO) met Finance Minister Nirmala Sitharaman on Friday with demands including minimum pension of Rs 7,500 per month with dearness allowance.

The delegation, led by Commander Ashok Raut, National President of Employees’ Pension Scheme (EPS) 95 National Movement Committee (NAC), met the Finance Minister. After the meeting, Raut said that the Finance Minister has assured the delegation that our demands will be considered sympathetically.

The Finance Minister will present the general budget in Parliament on February 1

According to Raut, ‘This assurance gives us hope. The government should announce a minimum pension and dearness allowance of Rs 7,500 in the upcoming budget. Anything less than this will fail to provide a dignified life to senior citizens.’

Finance Minister Sitharaman will present the Union Budget for the year 2025-26 in Parliament on February 1. In a press conference before the meeting, Raut mentioned the plight of more than 78 lakh pensioners associated with central and state government public sector undertakings (PSUs), private organizations, and factories across the country.

Agitation demanding free medical treatment

He said that pensioners have been agitating for seven-eight years demanding dearness allowance as well as increasing the minimum pension from Rs 1,000 to Rs 7,500 and free medical treatment for pensioners and their spouses. Raut claimed that despite the government announcing a minimum pension of Rs 1,000 in 2014, more than 36.60 lakh pensioners are still receiving less than this amount.

Banks should offer fixed interest rate products to customers: RBI

The RBI on Friday said that banks must mandatorily offer fixed interest rate products in the equated installment-based personal loan segment. The frequently asked questions (FAQs) on resetting the floating interest rate on equated monthly installment (EMI)-based personal loan segment also said that the circular covers all equated installment-based personal loans, irrespective of whether the interest rate is linked to an external benchmark or internal benchmark.

At the time of sanctioning loans, the annual interest rate/annual percentage rate (APR), as applicable, should be disclosed in the loan agreement. The FAQs also explain when and how frequently banks and other regulated entities (REs) should communicate with the borrower.

Annual interest rate information must be provided

During the tenure of the loan, any increase in EMI/tenure due to external benchmark rate should be communicated. The borrower is required to provide quarterly statements indicating at least the principal and interest charged till date, EMI amount, number of EMIs remaining and the annual interest rate for the tenure of the loan.

Most Read Articles:

- CBSE Board Exam Admit Card 2025: Admit cards for 10th and 12th board exams will soon be issued by CBSE, know update

- RBI has issued a warning! All ATM card holders should delete this number written on ATM card immediately, otherwise the account can be empty

- Credit Card Link UPI: Link your credit card to UPI from home, know step-by-step guide