FD rates of this Bank are also higher than some big banks. If you are thinking of putting money in FD, then this bank’s scheme can be a profitable deal for you.

FD Calculator Suryodaya Small Finance Bank: In the month of August, many banks have increased the interest rates on their Fixed Deposit Scheme. Earlier this month, the monetary policy of the Central Reserve Bank did not make any change in the policy interest rates (Repo Rate), after which many banks decided to offer higher returns on their FDs, including a small finance bank which Offering Tremendous Returns. FD rates of Suryoday Small Finance Bank are also higher than some big banks. If you are thinking of putting money in FD, then this bank’s scheme can be a profitable deal for you. You can take advantage of its high rate now.

Suryoday Small Finance Bank FD Rates

This small finance bank is giving tremendous returns to its customers on fixed deposits. Senior citizens are getting up to 9.10 per cent interest here, and with Annualised Yield it reaches 9.42 per cent. The bank is paying this much interest on FDs with maturity of 2 years to 3 years. 8.75 percent interest is being received on FDs within 15 months to 2 years. Within 1 year to 15 months and above 5 years FD is getting 8.75% interest. These new rates have come into effect from 7th August.

Talking about the general customers, here also the bank is giving the highest returns on FDs of 2 to 3 years. On FDs maturing within 2 to 3 years, you will get returns at an interest rate of up to 8.60%, which will reach 8.88% with the annualized yield.

FD Calculator: If you want to invest 5 lakhs

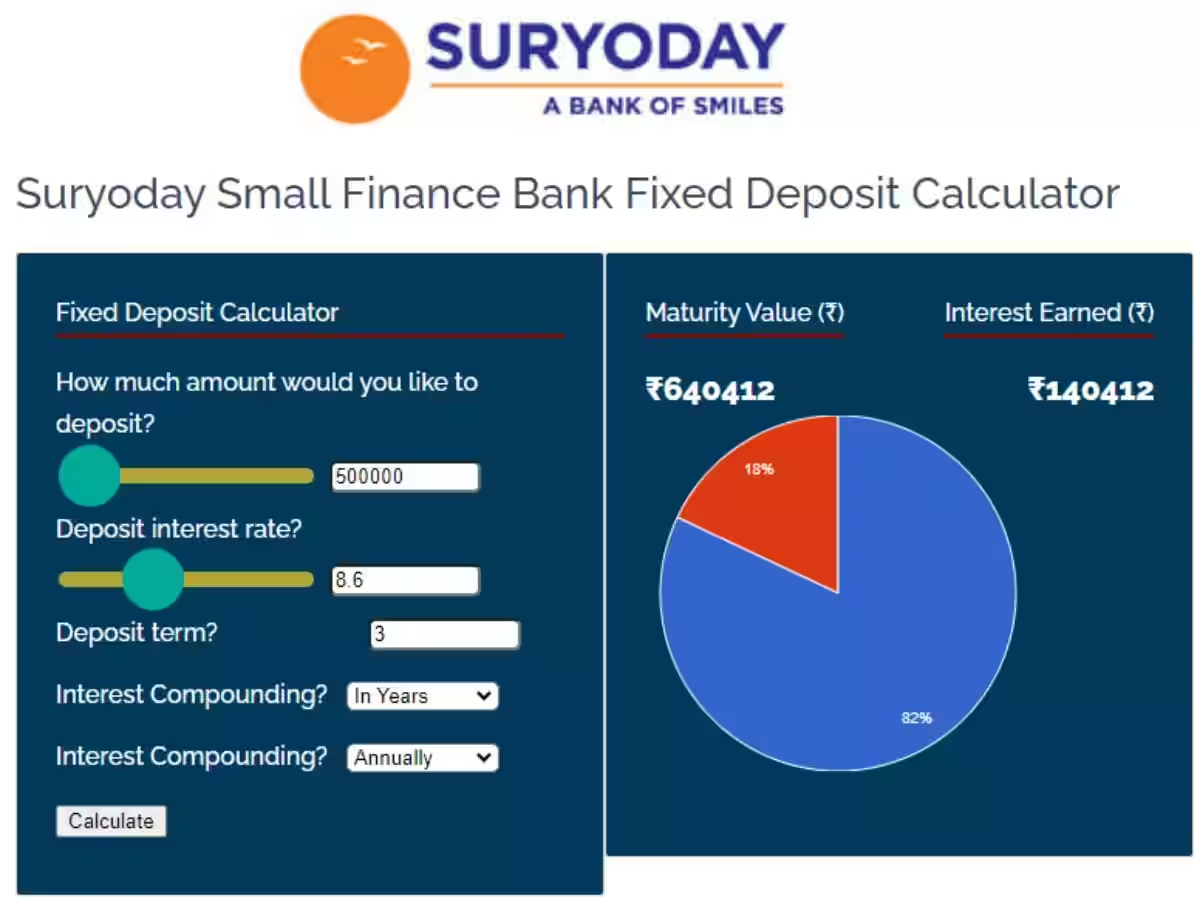

If you invest 5 lakhs in the general category for three years, then the calculation of investment at the interest rate of 8.60 will be something like this.

- Investment amount – 5 lakhs

- Interest rate – 8.60%

- Deposit term – 3 years

- If the interest is compounded annually then-

- The maturity value of your investment will be – Rs 6,40,412

- Earning from interest – Rs 1,40,412

FD Calculator for Senior Citizens

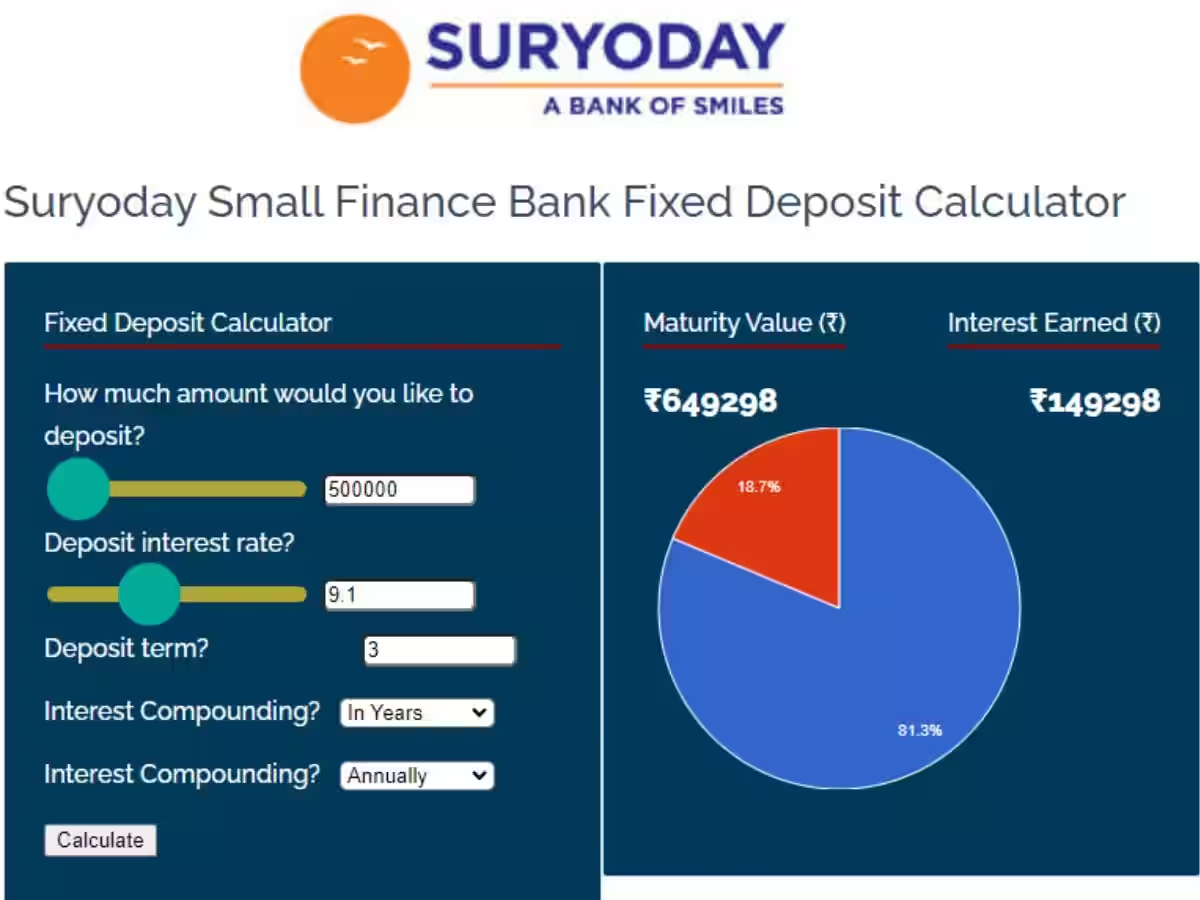

Senior citizens are getting returns at the rate of 9.10%, in such a situation, the calculation of the return that will be received on the investment of 5 lakhs for three years will be like this.

- Investment amount – 5 lakhs

- Interest rate – 9.10%

- Deposit term – 3 years

- If the interest is compounded annually then-

- The maturity value of your investment will be – Rs 6,49,298

- Earning from interest – Rs 1,49,298

If calculated according to the annualized yield for senior citizens at the rate of 9.42%, then they will get Rs 6,54,669 on maturity on an investment of Rs 5 lakh, in which interest income will be Rs 1,54,669.