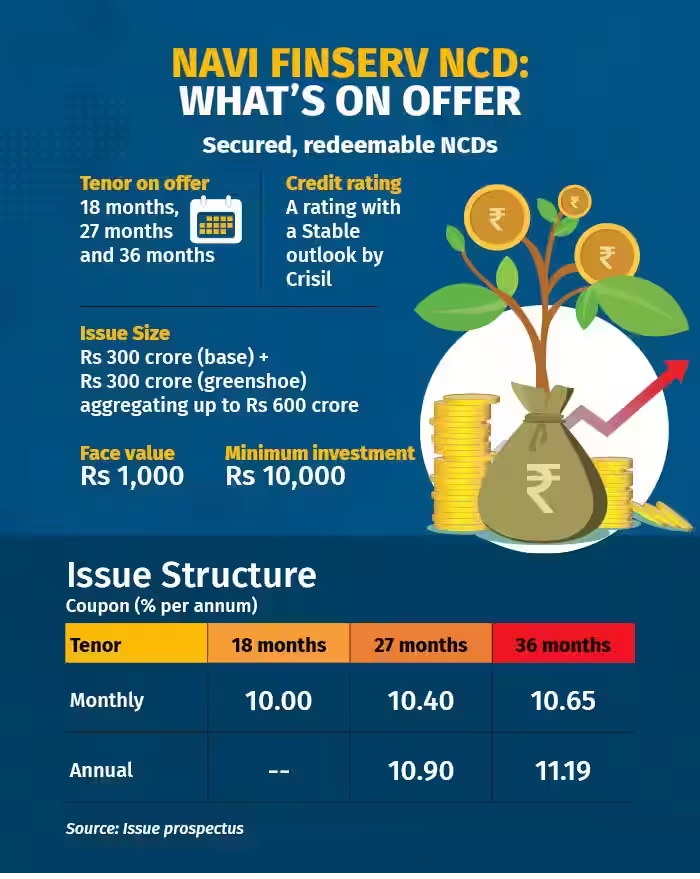

The NCD issue of Navi Finserv opened for investment on 26 February. There is a chance to earn more than 11 percent interest rate in this. This is much higher than the interest rate of bank FD. The company is going to raise Rs 600 crore from this issue.

Sachin Bansal’s Navi Finserv has launched NCD issue. The company is going to raise Rs 600 crore through this. The interest rate of this non-convertible debenture is 11.19 percent per annum, which is much higher than the fixed deposits of banks. The total bond size includes a green shoe option of Rs 300 crore. Navi Finserv is an NBFC. Navi Technologies is its parent company. This issue has opened on 26 February. Investments can be made in this till March 7.

Opportunity to earn 11.19 percent interest

CRISIL Ratings has rated this NCD as Stable with Stable Outlook. This issue has investment options for different tenures. These include NCDs of 18 months, 27 months and 36 months. Their interest rate ranges between 10 percent to 11.19 percent. The company will use the money raised from this issue to provide loans to customers, repay its debts and other corporate needs.

Third NCD issue in two years

This is the third issue of Navi Finserv in the last two years. The company had raised Rs 495 crore in FY 2023 from the first issue. It had raised Rs 481 crore from the second issue, which came during the same financial year. According to CRISIL, Navi Finserv has expanded its business. The gross non-performing assets (NPA) of the company is also low. He said in his report, “There has been improvement in asset quality in the last two-four quarters.”

Good demand for Navi Finserv’s NACD

CRISIL has said that as the business has grown, the company’s risk management system has improved. Deepak Panjwani, Head (Debt Markets), GEPL Capital, said, “This is in the NBFC retail loan space, which is growing rapidly. Investors can invest in this issue as in the previous bond issue of Navi Finserv. “It is trading well. There is good demand among retail and HNIs. The maximum maturity is 36 months, which makes it attractive for investment.”

Should you invest?

Investors need to keep in mind that this NCD of Navi Finserv has high credit risk as it does not carry a AAA rating. Triple A rating is considered the safest. Investors should avoid investing in low rated NCDs. The reason for this is that there is more risk in it. It is important to understand that withdrawing money from NCDs can be a little difficult. The reason for this is that the Indian debt market is not very big yet. The issue of tax will also have to be kept in mind. Tax is levied on the interest received from NCDs. The tax rate will be according to the slab of the investor.