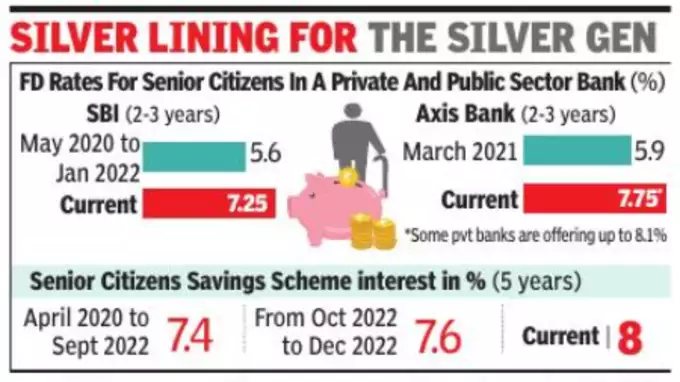

RBI had increased the repo rate five times last year. Due to this, all types of loans including home loans have become costlier. But those who invest in FD have become silver. For senior citizens, for the first time in three years, the interest on FD has reached eight per cent. It fell to 5.5 per cent during the Corona pandemic.

There is good news for those investing in FD ie Fixed Deposit (FD). For the first time in three years, the interest rate on FD has reached eight per cent. Many banks are offering eight per cent or more interest on FDs for senior citizens. RBI had increased the repo rate five times last year to control inflation. Due to this, all types of loans including home loans have become costlier for the people. But those investing in FDs have benefited. This has especially benefited senior citizens who depend on the income from FD interest. There was a time during the Corona epidemic when the interest on FD fell to 5.5 per cent. The reason for this was that there was abundance of cash in the market. But now the situation has changed.

Many private banks are now paying eight per cent interest on FDs and public sector banks 7.5 per cent. Now many senior citizens are thinking of breaking old FDs and making deposits at new rates. An elderly woman in Mumbai had done an FD of Rs 2.5 lakh in a private bank at the end of 2020 at 5.75% for three years. In this his son helped him. When he came to know that now he is getting 7.75% interest on the same tenure, he broke his old FD and then put it in FD at the new rate. Now he will get an interest of around Rs 20,000 annually.

Who is paying the highest interest

Last month, the government increased the rate on Senior Citizen Savings Scheme (SCSS) to eight per cent. This rate fell to 7.4 per cent during the pandemic. But now a days the difference between SCSS and FD has narrowed down. Some banks are offering higher rates to super senior citizens ie elders above 80 years. For example Union Bank of India is giving them 75 basis points more interest than general customers. The bank is giving 8% interest on 700 days deposit. Similarly, Punjab National Bank is giving 80 bps more rate than the regular rate to super senior citizens. He is getting 8.1 percent interest on 666 days.

Similarly, another retired person from Mumbai broke the FD arranged a year ago. The reason for this is that now he is getting two percent more interest on FD. These investors did not face any penalty on this but experts say that the benefit depends on case to case. Gaurav Gupta, founder and CEO of lending digital platform MoneyWide, said breaking existing FDs can be beneficial for those who do not have to pay the penalty.

What is 1-2-3 Formula

Dinesh Rohira, CEO and founder of 5nance.com, said that instead of depositing a lump sum, small amounts should be deposited for multiple tenures. There should be a fixed target or financial goal for every deposit. This will make investment more liquid. If you have made a five-year FD and after three years you need money, then you will have to pay a penalty of 0.5 to 1 percent for breaking the FD. On the other hand, if you have four small FDs of one, two, three and four years, then you will have money at the time of need and you will not have to pay penalty for this.