FD Rates: Shriram City Union Finance has increased the interest rates on fixed deposits of different tenors by 15-25 basis points. The new rates have come into effect from May 20.

FD Rates: Along with getting expensive loans, interest rates on deposits have also started increasing. Recently, many banks have increased interest rates on fixed deposits (FDs) of different tenors. After banks, Non-Banking Financial Companies (NBFCs) are also increasing the rates on their FD rates. Shriram City Union Finance has increased the interest rates on fixed deposits of different tenures by 15-25 basis points. The new rates have come into effect from May 20. After the revised rates, now NBFCs will pay 7.9 percent annual interest on FDs of 5 years to regular customers. Apart from this, senior citizens will get 0.50 percent more interest.

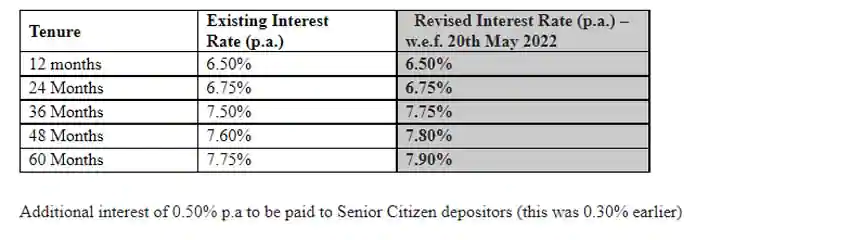

According to a statement issued by Shriram City Union Finance, the company has increased the interest rates on FDs of 36 months to 60 months by 15 basis points. The interest rates on deposits of 12 to 24 months have not changed. NBFCs have increased the interest by 0.25% on FDs of 36 months i.e. 3 years, 0.20 percent on FDs of 4 years and 0.15 percent on FDs of 5 years. Apart from this, senior citizens will get 0.50 percent more interest on deposits. Earlier 0.30 percent interest was available.

Revised FD Interest Rates

Banks also increased rates on FD

After the change in the repo rate of RBI, SBI, ICICI, Axis, PNB, HDFC, Indian Overseas Bank, Canara Bank and Kotak Mahindra Bank have changed their interest rates. For example, SBI has increased the deposit rates from 0.40 to 0.90 percent. Kotak Mahindra Bank has increased the interest rate by 0.35 percent on fixed deposits up to Rs 2 crore.