HIGHLIGHTS

-

- A fine of Rs 5,000 if return filed between August 1 and December 31

- A fine of Rs 10,000 if return filed after December 31

- If income is less than Rs 5 lakh, then the fine is limited to Rs 1,000

- PAN (permanent account number) provided to you by the I-T department

- Bank statements (all banks you hold account in)

- Investment proofs to claim deductions

- Form 16 (for salaried employees)

- Form 26 AS (a summary to give you details of TDS deductions made on your behalf)/ TDS certificates

- If you have salary income, house property income from a single house or income from other sources (like interest income) and the total does not exceed Rs 50 lakh: ITR 1 (SAHAJ)

- For individual or HUF with income criteria other than mentioned above and does not have income under head business or profession: ITR 2

- Rs 5,000 if the return is filed before December 31 but after July 31 of the concerned financial year

- Rs 10,000, if filed later than December 31

- If the total income does not exceed Rs 5 lakh, then the fine is limited to Rs 1,000.

If you haven’t filed your income-tax (I-T) return for financial year 2017-18 yet, delaying further might not be such a good idea. The last day for filing your income tax return is July 31. So if you don’t file your return within the due date, the I-T department shall levy a late payment fees up to Rs 5,000.

Do you have to file a return?

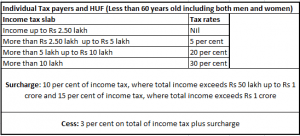

If total income exceeds the taxable limit and you are an individual or HUF (Hindu undivided family) that is not subject to an audit requirement, then you must file your return by July 31. Basically, all non-corporate assesses whose books of accounts are not liable to audit requirement.

Do you need any documents to file your return?

Yes, a few basic ones.

However, there is no need to attach these documents along with the income tax return. As per I-T department, these documents should be retained by the concerned person filing the return, in case the tax authorities want to verify them.

Which ITR to file?

What happens if you don’t file your return within due date?

As per section 234F of the Income Tax Act, if an assessee fails to file the return within the prescribed due date, then he or she is likely to be fined: