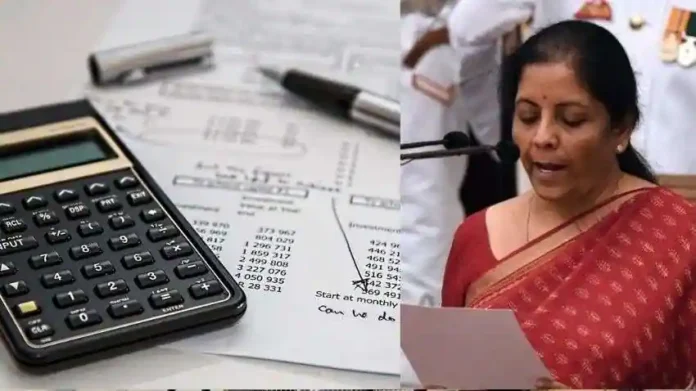

Union Minister Nirmala Sitharaman has given a big relief to the taxpayers. If your income is Rs 1 lakh per month, then now you will not have to pay any tax. The Finance Minister has announced that there will be no tax on income up to Rs 12.75 lakh. Now you can file IT returns of the last 4 years together. The limit of TDS for senior citizens has been increased from 50,000 to 1 lakh.

Finance Minister Nirmala Sitharaman made a big announcement and said that now there is no need to pay any tax on annual income of 12 lakhs. This change has been made under the new tax system. Earlier, no tax was to be paid on income of 7 lakhs. Standard deduction has been kept at Rs 75,000. Along with this, Union Finance Minister Nirmala Sitharaman also announced the new Income Tax Bill. She said that the New Income Tax Bill will be brought next week.

General

1. Kisan Credit Card limit enhanced from Rs. 3 lakh to Rs. 5 lakh

2. Additional Infra in 5 IIT’s set up after 2014. IIT Patna to be expanded

3. 10,000 more seats to be added in medical colleges in next year and 75,000 in next five years

4. Rs. 500 Cr. for Centre for Excellence in AI

5. Social Welfare Scheme for GIG workers

6. Extension of Jal Jeevan Mission till 2028

7. Urban Challenge Fund of Rs. 1 lakh crore to be set up

8. Green field airports to be facilitated in Bihar in addition to Patna airport

9. Rs. 20,000 Cr. for Private Sector R&D

10. Top 50 tourist destinations to be developed. Focus on destinations linked to Budha

11. ‘Heal in India’ to be promoted

12. FDI limit for Insurance sector to be raised to 100% if entire premium invested in India

13. Revamped KYC Registry to be rolled out

14. Customs: Rationalize tariff structure

15. 36 life saving drugs exempt from duty & 5% duty on 6 life saving drugs

Direct and Indirect tax

1. New Income tax Bill Next Week

2. New Income tax Bill to be simple and close to present

3. Personal Income Tax Reforms for Middle class

4. NIL Income tax upto 12,00,000

5. Income Tax slab changed

6. TDS and TCS rationalize

7. Limit for TDS on rent increased from Rs. 2.4 lakh to Rs. 6 lakh

8. Limit for TDS on Senior citizens enhance from Rs. 50,000 to Rs. 1,00,000

9. TCS removed on remittance for education purposes

10. ‘Updated Return’ time limit enhanced to 4 years from present 2 years