Form-16 is a very important document while filing ITR. Return cannot be filed without this document. Now while filing the return, the details of Form-16 have to be checked and submitted and later e-verified. Today in this article we will tell you about the rules of Form-16 and the details included in it.

Salaried persons need Form-16 while filing Income Tax Return (ITR). Form-16 is a very important document for ITR. Today we will tell you what are the rules of Income Tax Department for Form-16 and what information is included in Form-16.

What is the rule regarding Form-16

According to the rules of the Income Tax Department, all companies have to issue Form-16 after filing TDS return. Let us tell you that this year the last date for filing TDS was 31 May 2024.

This means that employees will get Form-16 by 16 June 2024. If the employee does not get Form-16, then he should talk to HR.

What is Form 16?

Form-16 contains salary and tax information. It contains information about the source of income along with tax deduction and how much tax is levied on which income. Now the details of Form-16 are already present in the ITR.

Now the taxpayer only has to check and submit the details of Form-16 while filing ITR. After filing ITR, the taxpayer has to e-verify it.

How many parts does Form-16 have?

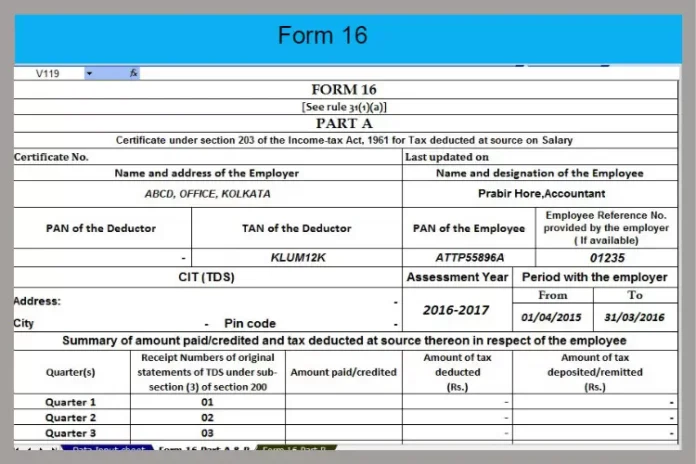

Form-16 is in two parts. Part A of Form-16 contains the company’s TAN number, company’s PAN number, employee’s PAN number, address details, assessment year, job tenure information. Apart from this, it also contains details of TDS.

Part B of Form-16 contains tax details along with the taxpayer’s salary breakup. Apart from this, it also contains information about the taxpayer’s gross salary, net salary, house rent allowance, PF account, professional tax, tax deduction, investment, saving plan etc.

Form 26AS is also important

Form 26AS is also important. Form 26AS is a consolidated tax statement. It contains details of the taxpayer’s income source and tax deduction. Form 26AS can be downloaded from the e-filing account on the official website of the Income Tax Department.

In such a situation, while filing ITR, the taxpayer should match Form 26AS and Form-16. If there is a difference in the information given in these two forms, then the ITR can also be rejected.