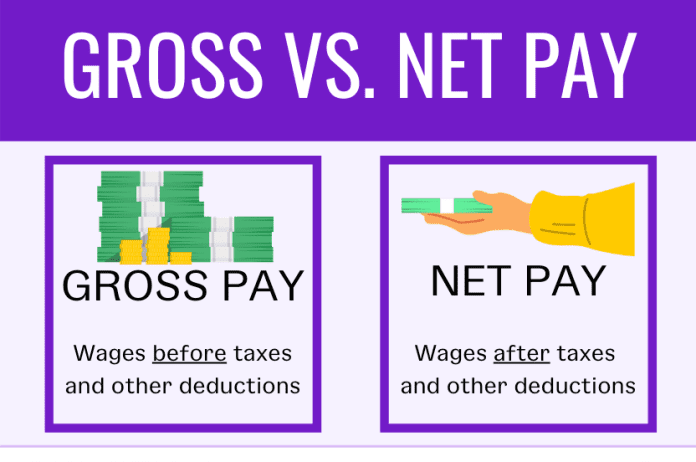

Gross Pay vs Net Pay: The amount of salary transferred to your account at the end of the month is your Net Salary. Your net salary is different and less than the gross salary calculation.

If you have joined a new job or are about to join, then the biggest task is to understand the calculation of salary. To understand this, you have to see what will be your basic salary, what will be the monthly CTC, how much will be your in-hand salary (In Hand Salary Calculator India), along with many other things have to be considered. Your net salary is also usually called take-home salary or in-hand salary. This is the amount or income that an employee gets after tax, provident fund and other such deductions are made.

That is, the amount of salary transferred to your account at the end of the month is your net salary. Your net salary is different and less than the gross salary calculation. Net salary can be equal to gross salary only when the income tax is zero and the employee’s salary is less than the limit of the tax slab prescribed by the government. Here we will tell you what is the difference between CTC and in-hand salary and how to calculate net salary and gross salary.

What is CTC

CTC means Cost to Company. This is the cost that a company spends on its employee. It includes basic salary, gross salary, provident fund and gratuity as well as other facilities provided by the company. CTC is fixed on an annual basis, which is also called annual package.

In hand salary

Net salary or in hand salary is that which you get every month after all kinds of deductions are made by the company.

Also Read- Ayushman Bharat Scheme: How to apply for Ayushman Bharat card, who are eligible for free health insurance, which diseases are covered

Difference between CTC and in hand salary

CTC includes the total amount spent by the company on the employee, while in hand salary is given after making many types of deductions.

CTC salary includes the cost of PF, medical insurance and other facilities, while all these amounts are deducted from in hand salary.

Use Salary Calculator to calculate In-hand Salary

You can use Salary Calculator or Take Home Salary Calculator to calculate your In-hand Salary i.e. net salary. For this, you have to follow the steps given below

Step 1. To calculate net salary, first of all you have to enter your annual CTC.

Step 2. Now enter other variables like annual bonus etc.

Step 3. Then enter your basic salary.

Step 4. After calculation, your in-hand salary will come out.

Step 5. If you want to calculate your actual in-hand salary, then you can calculate your in-hand salary by calculating HRA, rent, gratuity, EPF and other allowances.

You can also use this formula to calculate net salary (take-home salary).

- Net salary = Gross salary – Taxable income

- That is, to calculate net salary, you should first know your gross salary. Gross salary is neither your cost to company (CTC) nor your basic salary. Gross salary is obtained after deducting EPF and gratuity from CTC.

- Gross salary = CTC – EPF – Gratuity

- After calculating gross salary and taxable income, you can calculate your net salary using the formula mentioned above.

Related Articles:-

TCS 40000 employees get income tax notice over TDS, know details