After the increase in the report by the Reserve Bank of India, everyone has started investing money in fixed deposits and taking advantage of the increased rates. But let us tell you that the bank in which you are taking only 6% to 8% interest on fixed deposit, the same bank is giving 18% return in its mutual fund.

HDFC Mutual Fund

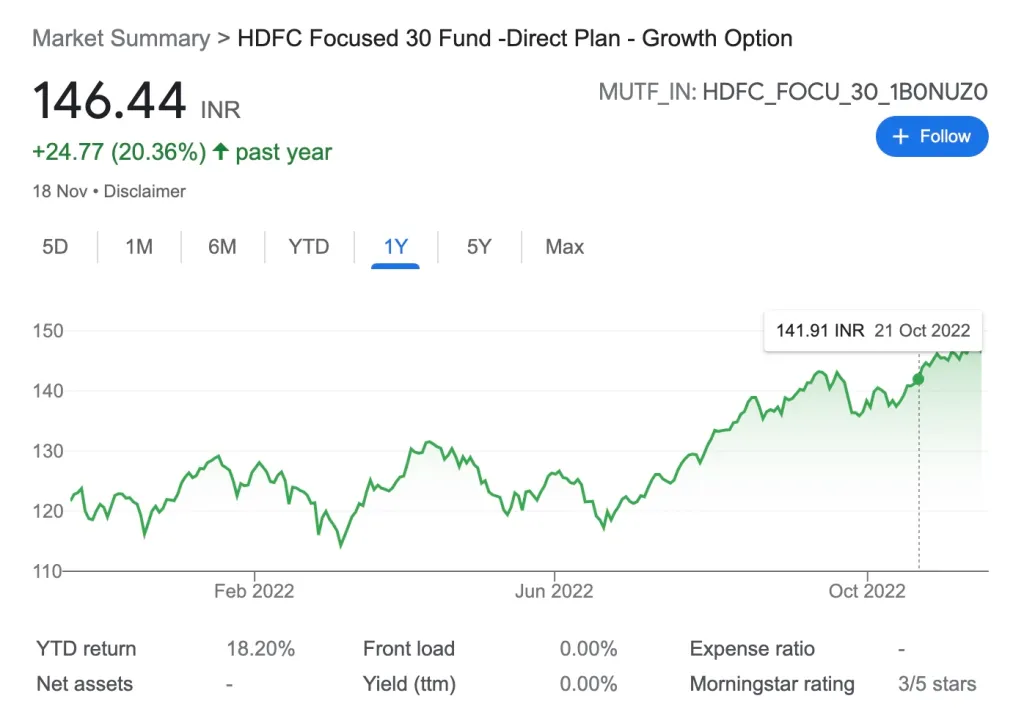

HDFC Focused 30 Fund Direct Plan-Growth included in HDFC’s FLEXI CAP has given a return of 20.36% in just 1 year, while its HDFC Flexi Cap Direct Plan-Growth has given a return of 16.04%.

HDFC Fixed Deposit Rates Nov 22

Applicable from 8th Nov, 2022

(Senior Citizen Rates do not apply to NRIs | Minimum tenor for NRE Deposit is 1 Year.)

| Tenor Bucket | < 2 Crore | |

|---|---|---|

| Interest Rate (per annum) | **Senior Citizen Rates (per annum) | |

| 7 – 14 days | 3.00% | 3.50% |

| 15 – 29 days | 3.00% | 3.50% |

| 30 – 45 days | 3.50% | 4.00% |

| 46 – 60 days | 4.00% | 4.50% |

| 61 – 89 days | 4.50% | 5.00% |

| 90 days < = 6 months | 4.50% | 5.00% |

| 6 mnths 1 days <= 9 mnths | 5.25% | 5.75% |

| 9 mnths 1 day to < 1 year | 5.50% | 6.00% |

| 1 year to < 15 months | 6.10% | 6.60% |

| 15 months to < 18 months | 6.40% | 6.90% |

| 18 months to < 21 months | 6.50% | 7.00% |

| 21 months – 2 years | 6.50% | 7.00% |

| 2 years 1 day – 3 years | 6.50% | 7.00% |

| 3 year 1 day to – 5 years | 6.50% | 7.00% |

| 5 year 1 day – 10 years | 6.25% | 7.00%* |

HDFC Savings Interest Rates Nov 22

If you have kept your savings account in HDFC Bank, then your bank is giving you savings interest in such a way that the complete table is as follows.

- HDFC Bank offers you 3% savings interest up to an amount of 50 lakhs.

- The bank offers you 3.5% interest on the amount above 50 lakhs.