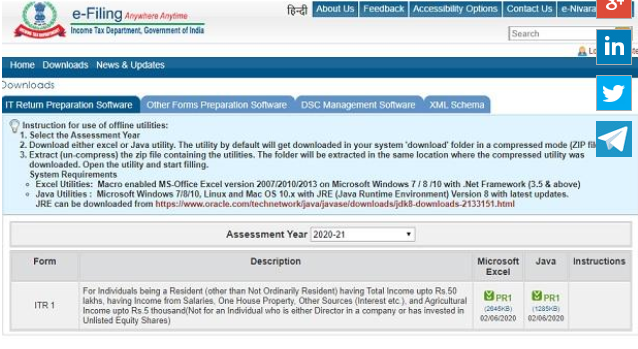

The department has released the ITR-1 utility (e-form) on its e-filing website available in Excel and Java formats

ITR can be filed by downloading the software in Excel or Java utility

Once you complete filling the asked details, you can generate an XML file and upload it on I

T Dept’s e-filing website

After you download the excel or the java version of the utility form, extract the downloaded utility ZIP file and open the Utility from the extracted folder. Then provide your information, fill the applicable and mandatory fields of the ITR form. Validate all the tabs of the ITR form and Calculate the Tax. Then generate and Upload the XML to e-Filing portal by entering user ID (PAN), Password.Click on the ‘e-File’ menu and click ‘Income Tax Return’ link and Submit the ITR.

From XML Schema you can download all the essential that you will need while filing ITR

Collect documents such as Form 16, salary slips, and interest certificates and Form 26AS. Keeping them handy will help you compute your gross taxable income and will provide you with the details of tax deducted at source (TDS) from your income in 2019-20.

However, taxpayers who are eligible to file ITR-1 and ITR-4 also have the option to file it online without downloading any software utility: Log in to your account