If you also want to take loan for agriculture at only 4% interest rate, then you must apply for Kisan Credit Card Scheme.

After applying, Kisan Credit Card will be issued by the bank in your name. Using which you can withdraw up to Rs 3 lakh or buy agricultural machinery.

Now you would like to know that how can I get a loan at only 4 percent interest rate? So the fact is that you have to pay only 4% interest, the government will subsidize you for the rest of the interest.

Kisan Credit Card Yojana 2021

| Article | kisan credit card scheme apply |

| beneficiary | all farmer brothers |

| Purpose | low interest rate loan |

| Application Type | online and offline |

| official website | www.pmkisan.gov.in |

Documents Required To Get Kisan Credit Card

- Farmer Registration

- Aadhar card

- Bank passbook

- land receipt

- KCC Application Form

How To Apply Kisan Credit Card Offline?

Step-1 First of all you have todownload KCC Application Form PDF for Kisan Credit Card Offline Application by clicking on the button below.

Step-2: Print the PDF form and fill it correctly. As in the photo below.

Step-3 With the filled KCC form, Aadhar card, bank passbook, Xerox of land receipt and photo is to be pinned and deposited in your bank branch.

Step-4 The bank manager will check the application given by you, after that you will get the approval for the loan.

Step-5 As soon as the loan is approved, a credit card will be issued in your name under the Kisan Credit Card Scheme.

How To Apply Kisan Credit Card Online?

To apply KCC Online you must have CSC.

That is, if you have the ID and password of CSC, then only you will be able to apply online for Kisan Credit Card by following the steps mentioned below.

Step-1 First of all, you have to go to the official website of the Ministry of Agriculture and Farmers Welfare by clicking on the button.

Step-2 Next you haveto click on APPLY NEW KCC in the menu. After that enter the CSC User ID and Password and click on the SIGN IN button.

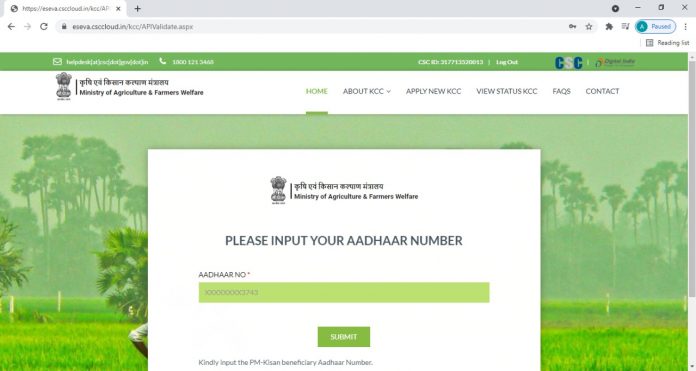

Step-3 Now you have to enter the Aadhaar number of the farmer andclick on the SUBMIT button.

Step-4 Now Kisan Credit Card online application form will open in front of you. Your name, father’s name, bank details etc. will already be filled in it.

Step-5 Next you have to fill some basic information. Name of the village, Khasra number of the land etc. and click on SUBMIT DETAILS .

Step-6 Next, you have to pay Rs 35 from your CSC wallet. On paying Rs 35, only Rs 12-13 will be deducted from your account.

You have to make payment by clicking on MAKE PAYMENT .

Step-7 As soon as the payment is completed, a receipt will appear in front of you.

Take a print out of this receipt and submit it along with Aadhar card, bank passbook, Xerox of land receipt and pin up photo to your bank branch.

Step-8 The bank manager will check the application given by you, after that you will get the approval for the loan.

Your Kisan Credit Card will be issued as soon as the Kisan Credit Card application is verified.

Kisan Credit Card Related Questions And Answers

Q1. How much land should be there for Kisan Credit Card Scheme application?

Ans: For this you should have minimum 10 Decimal land i.e. you should have at least 0.10 acres of land.

Q2. What is required to get Kisan Credit Card?

Ans: To get Kisan Credit Card, you should have Kisan Registration, Aadhar Card, Bank Passbook and land receipt.

Q3. How much loan can I get on 1 bigha or 1 acre of land?

Ans: How much loan you can get on one bigha or one acre of land depends on the location of your land and the bank which is giving you the loan.

According to an estimate, you can get a loan of up to Rs 3 lakh on 1 acre.

Q4. How to get PM Kisan Loan?

Ans: To take PM Kisan loan, you have to apply online for Pradhan Mantri Kisan Credit Card Scheme. The process of which is explained in the above article.

Q5. If I get a loan under the KCC scheme, can I apply for another loan again?

Ans : Yes! Absolutely you can apply for a loan under any other scheme. You will get both KCC loan and other loan.

Q6. What should be the age to take advantage of Kisan Credit Card Scheme?

Ans: To take advantage of KCC scheme, your minimum age should be 18 years and there is no maximum age limit.