How to invest in National Saving Certificate: There are many saving schemes in the country in which the general public can invest. Among all the saving schemes of the Government of India, National Saving Certificate is one such scheme in which people have a lot of faith. This is a safe investment option with a fixed return.

How to invest in National Saving Certificate : There are many saving schemes in the country in which the general public can invest. Among all the saving schemes of the Government of India, National Saving Certificate is one such scheme in which people have a lot of faith. This is a safe investment option with a fixed return. It has gained popularity among investors due to its tax benefits and attractive return rates.

The Finance Ministry decides the interest rate on NSC every quarter. The interest rate on NSC for the fourth quarter of the financial year 2023-24 (January-March) is 7.7% per annum. This rate is the same as the previous quarter (October-December 2023). The interest rate on NSC is calculated annually.

How to invest in NSC?

- Joining NSC Investing is an easy process. In this you can invest online and offline. People who are not able to use the internet for their investments can buy NSC offline.

- Visit Nearest Post Office: NSC can be purchased from any post office branch across India.

- Fill the NSC Application Form: The form will be available from the post office or online. Fill your information and file the nominee.

- Provide KYC documents : Provide your ID proof like Aadhar PAN card and address proof. Deposit the amount of money you want to invest.

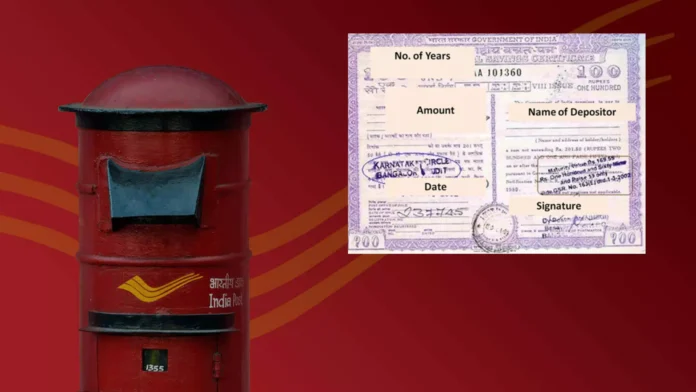

- Get your NSC certificate : After completing all the formalities, you will be issued NSC certificate.

This is how you can invest in NSC in online mode

- Use your DOP Internet Banking: If you have a Post Office Savings Account and have Internet Banking facility, you can invest in NSC online.

- Access DOP Net Banking: Go to “General Service” and click on “Service Request”.

- Click on New Request: Select the “New Request” option and then select “NSC Account – Open an NSC Account (for NSC)”.

- Decide your investment amount: Enter the amount you want to deposit and link it to your post office savings account.

- Password: Agree to the terms and conditions and enter your transaction password.

- Download the receipt : This is proof of entry of your online investment.