HIGHLIGHTS

Directing lump sum inflow towards prepayment is key. Noida-based chartered accountant Amardeep Singhal used lump sum payments to reduce his home loanoutstanding from Rs 33 lakh to Rs 18 lakh.

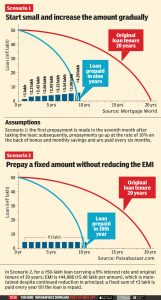

“I received arrears from clients in two tranches of Rs 10 lakh and Rs 5 lakh in 2016. I decided to use this to reduce my loan burden,” says Singhal. His decision entailed a compromise putting off buying a car. A home loan of Rs 50 lakh with an interest rate of 9% and a 20-year tenure can be paid off within 9.3 years by making a prepayment of Rs 3 lakh at the end of every 12th EMI while keeping the EMI constant (see graphic).

Bank on savings

Mumbai resident Rohit Mehta had planned to arrange funds for buying a house and repay it at the earliest before he took a loan of Rs 20 lakh. “I did not use all my accumulated savings. After taking the loan, I used the amount to make part-prepayments of Rs 15 lakh through the period,” he says. If you haven’t planned as efficiently as Mehta, do not despair. Old investments can also be unearthed and liquidated to make prepayments.

Increase EMI, reduce tenure

If you neither have accumulated savings nor funds, you can still prepay the loan. “If a borrower with a Rs 50-lakh loan at an interest rate of 9% and tenure of 20 years decides to increase the EMI by 15% annually, the loan can be closed in the 97th month,” says Vipul Patel, Founder, Mortgageworld. If raising the EMIs by 10-15% looks difficult, you must ensure that rate hikes do not extend your tenure. “When interest rates go up, don’t extend the tenure, but maintain or, rather, increase the EMI amount. In case rates are reduced, opt for a shorter tenure instead of reducing EMI. This will help you pay off the loan faster,” says Nirmal Rewaria, co-founder, Finpeace Technologies.