In the e-calendar, the Income Tax Department writes that welcome to a new era where the tax system is becoming uninterrupted, faceless and paperless.

Tax Calendar: As soon as the new year arrives, you also have to do your tax planning. However, the Income Tax Department has also extended the date for making tax returns. The Income Tax Department is helping you in your tax planning. The ID department has released the tax planning calendar for the year.

The Income Tax Department has released an e-calendar for the year 2021. All the tax related information is given in this calendar.

In the e-calendar, the Income Tax Department writes that welcome to a new era where the tax system is becoming uninterrupted, faceless and paperless.

In such a situation, the department says that it is very important for all taxpayers to remember certain dates related to tax, so that you can make tax related work even easier.

With the help of the new calendar, you will get ease in filing tax returns and tax planning. If you include this calendar in your tax planning, then you can definitely avoid penalty in late filing.

Know what is the income tax e-calendar

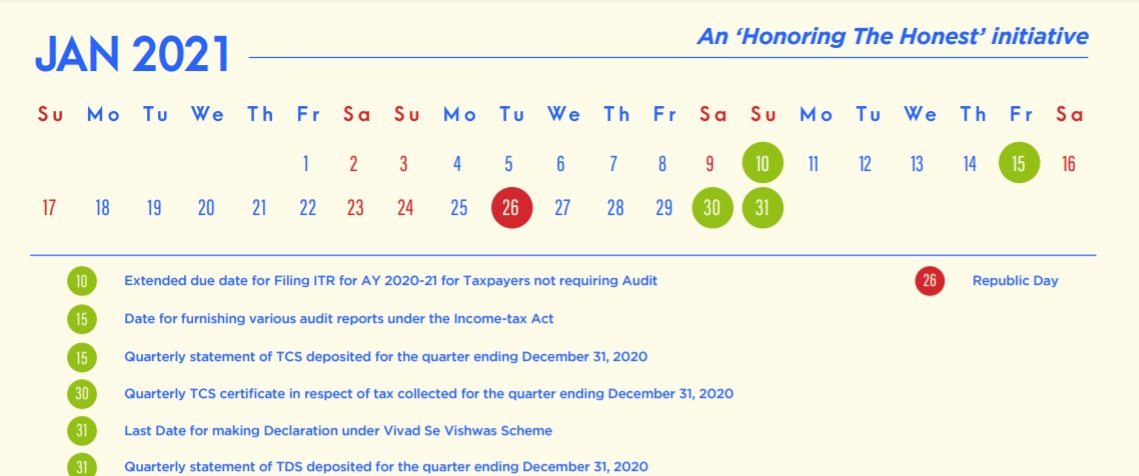

January 2021

The 10th of January is the last date to file an ITR without audit. To this date, you can file ITR for assessment year 2020-21.

Under the Income Tax Act on January 15, all audit reports can be submitted. To this day, you

can submit a quarterly statement of TCS deposits for the quarter ended December 31, 2020.

Quarterly TCS certificate can be submitted in respect of tax collected for the quarter ended January 30 last month. And 31 January is the last date for declaration from the dispute under the Vivad Se Vishwas Scheme.

Feb 2021

February 15 is the deadline for filing an audited income tax return for assessment year 2020-21. On this day, you can also submit a Quarterly TDS Certificate for the quarter ended December 31, 2020.

March 2021

On March 15, the fourth installment of advance tax can be submitted for assessment year 2021-22.

March 31 is the deadline for filing delayed or revised returns for assessment year 2020-21. On this day, the quarterly statement of TDS / TCS submitted for the first quarter and second quarter for the financial year 2020-21 can be submitted.

May 2021

May 15 is the deadline for submission of TCS statement for the quarter ended 31 March 2021.

TDS statement can be submitted on 31 May for the quarter ending 31 March 2021.

The same day is the due date for submission of details of financial transactions under 285BA in relation to the financial year 2020-21.

June 2021

June 15: You can submit the first installment of advance tax for assessment year 2022-23.

On the same day, TDS Certificate – Form 16 can be submitted to the employees for assessment year 2021-22. On the same day, submit quarterly TDS certificate for the quarter ending March 31, 2021.

July 2021

On July 15, submit stentment of TCS deposit for the quarter ended June 30, 2021.

On July 30, you can submit TCS certificate for the quarter ended June 30, 2021.

Submit the TDS deposit stipend for the quarter ended 30 June 2021 on 31 July.

August 2021

Submit TDS certificate for the quarter ended 30 June 2021 on 15 August.

September 2021

On 15 September, submit the second installment of advance tax for assessment year 2022-23.

ITR file (corporate and non-corporate) for assessment year 2021-22 by 30 September, whose account book needs to be audited.

Also Read: Important News From Aadhaar PVC Cards: know what is Aadhaar PVC card, you can order from home sitting like this

October 2021

October 15: TCS deposit stent for the quarter ended September 30, 2021.

October 30: TCS certificate for the quarter ended September 30, 2021.

October 31: Stentment of TDS deposit for the quarter ended September 30, 2021.

November 2021

On 15 November: Submit TDS certificate (other than salary) for the quarter ended 30 September 2021. Submit ITR on November 30 for assessment year 2021-22.