Income Tax: In the recently presented budget, income up to Rs 12 lakh per annum has been made tax free. This system will come into effect from the next financial year. Meanwhile, the Income Tax Department is preparing to take strict action against tax evaders. It is eyeing about 40,000 taxpayers.

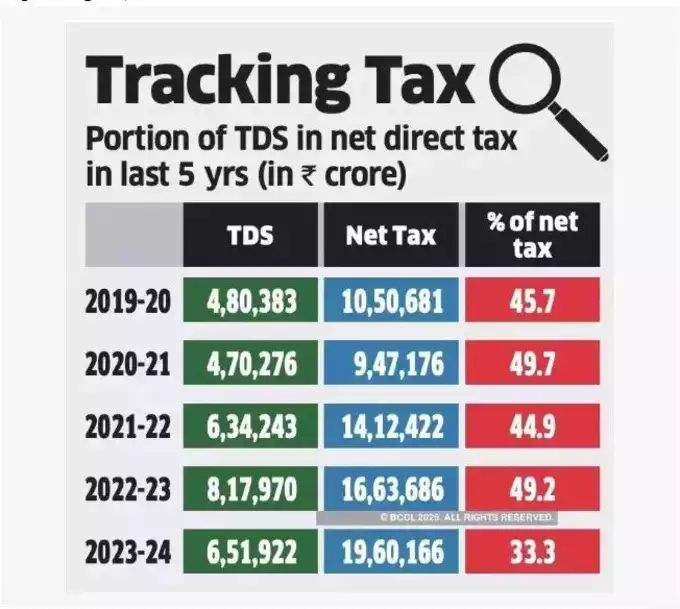

The Income Tax Department is preparing to run a big campaign across the country. Officials say that the campaign will be against those people and companies who have not deducted or deposited TDS / TCS. About 40,000 such taxpayers are under investigation. This action is being taken on the basis of tax deducted in the financial year 2022-23 and 2023-24. The Central Board of Direct Taxes (CBDT) has prepared a 16-point plan to catch TDS defaulters.

Apart from this, the data analytics team has prepared a complete list of such taxpayers for investigation. A senior official said, ‘We have the data of the analytics team. If someone has not deposited the tax, we will first inform them about it.’ The officers will focus on repeat offenders. They will investigate cases where there is a big difference in tax deduction and advance tax payment. Cases where there have been frequent changes and corrections in the name of the deductor will also be investigated. Also, companies that have used sick units or loss-making companies in audits will also be investigated.

What does the law say

The board has asked the assessing officers to report cases with large disallowances under Section 40(a)(ia) of the Income Tax Act. This section does not allow deduction in cases where TDS has not been deducted or deposited with the government. Tax officials will also keep a close watch on cases where TDS returns have been amended several times and the amount of default has come down significantly.

The board has asked field officers to also pay attention to complaints filed by deductors. Use data analytics to identify patterns and irregularities in TDS payments. The official said that like the department’s earlier campaigns, no one will be harassed in this too. In this year’s budget, the central government has announced rationalization of TDS and TCS rates. The number of rates and the limit of TDS deduction have been reduced.

Action on defaulters

The official said, ‘TDS compliance has been relaxed for honest taxpayers. But strict action will be taken against those who deliberately default. This will make the tax system fair and equitable.’ With this campaign, the government hopes that tax evasion will be reduced and revenue will increase. Also, honest taxpayers will get encouragement. This will also strengthen the country’s economy.

Most Read Articles:

- Infosys Salary Hikes: Good news…! Infosys increased the salary of employees up to 10%, know details

- 7th Pay Commission DA Hike: DA will increase again in March! You will also get 2 months arrears, know how much the salary will increase?

- Credit Card Link UPI: Link your credit card to UPI from home, know step-by-step guide