In many cases, it has been seen that the Income Tax Department has sent notices to adjust the many years old arrears with the current year’s refund. What should you do if this happens to you too? In such a case, is it enough to simply file a reply on the Income Tax portal?

New Delhi. E-filing of Income Tax Return (ITR) has made many things very easy for the taxpayer and the tax department. Online processing of revising ITR, issuance of information under section 143(1), filing of correction under section 154 and refund process is very fast.

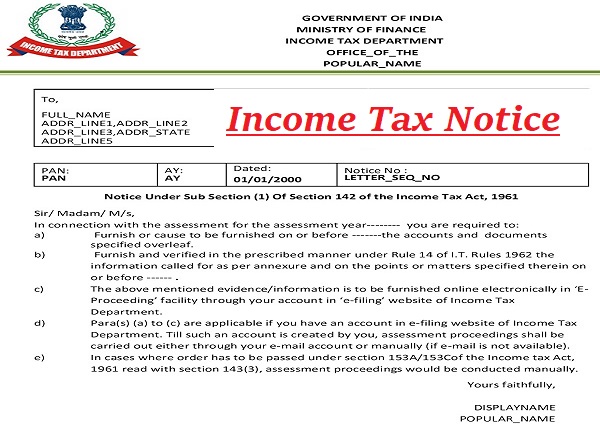

However, it has been observed that in many cases, taxpayers have received information u/s 245 demanding old arrears of previous years or being adjusted with the refund of the current year. In some cases, the amount sought to be adjusted pertains to prior assessment year 2012-13 i.e. when e-filing was not mandatory. Now the question arises that in such a case is it enough to file the reply on the Income Tax Portal only?

Adjustment with refund

Section 245 empowers the Income Tax Officers to adjust any arrears of the previous year with the amount to be refunded to the taxpayer. There is no time limit for adjusting the outstanding amount of the previous year with the amount to be refunded. Meaning as per this law, the arrears of tax for assessment year 2000-01 can be adjusted with the amount of refund for assessment year 2021-22.

Option to agree or disagree

However, such adjustment can be made only after giving notice in writing to the taxpayer and giving him an opportunity to respond to the proposed adjustment. The answer should be entered through the portal. The income tax portal provides an option to the taxpayer to agree or disagree with the demand and proposed adjustments.

Get 30 days time

The CPC provides 30 days (informed on the registered email address) from the date of issue of intimation to file a response. If the response is not filed within 30 days, the outstanding demand is deemed to have been accepted by the taxpayer and the refund is adjusted accordingly. Therefore, it is important that the taxpayer registers his dissent on the portal within 30 days.