Refund in New Income Tax Bill: Many people have expressed apprehension that those who file returns late in the new income tax law will not get a refund. The Income Tax Department has clarified on this issue.

Refund Under New Income Tax Bill 2025: Will those who file returns late not get a refund when the new income tax bill becomes a law? Such apprehensions are being expressed since the new Income Tax Bill 2025 was introduced in the Lok Sabha. Not only common taxpayers, many experts also expressed the same opinion through social media that the new tax bill has a provision of not giving any refund to taxpayers who file income tax returns (ITR) late. Many people are also demanding amendment in it, calling it a more stringent provision than necessary for taxpayers. On this issue, the Income Tax Department has tried to clarify the issue by putting its side. Let us know what this whole matter is.

Why was the question raised on income tax refund?

Actually, this issue arose due to clause 263(1)(a)(ix) of the Income Tax Bill 2025, which states that if a taxpayer wants to claim a refund, he has to file an income tax return within the stipulated time limit. This provision is quite different from the current Income Tax Act 1961, in which taxpayers can claim refund even if they file belated (late) returns by December 31.

Not only this, clause 433 of the new Income Tax Bill states that taxpayers can claim refund only at the time of filing returns. This further increased the apprehension that if a taxpayer files ITR after the stipulated time limit, he will not be able to claim tax refund, even if his TDS or tax has been deducted more for some reason.

What do the current rules for income tax refund say?

- Under the current law i.e. Income Tax Act 1961, if a taxpayer proves that the tax he has paid is more than his actual liability, then the excess tax amount is returned as a refund.

- According to section 237, if a taxpayer has deposited excess tax, then he has the right to get it back.

- According to section 139, the deadline for filing ITR for individual taxpayers is July 31, but under section 139(4), belated ITR can be filed till December 31. And refund can be claimed even at that time.

- Under section 234(F), if a taxpayer files ITR late, then he has to pay a fine of Rs 5,000. If his annual income is less than Rs 5 lakh, then this fine is reduced to Rs 1,000. But his right to claim refund does not end.

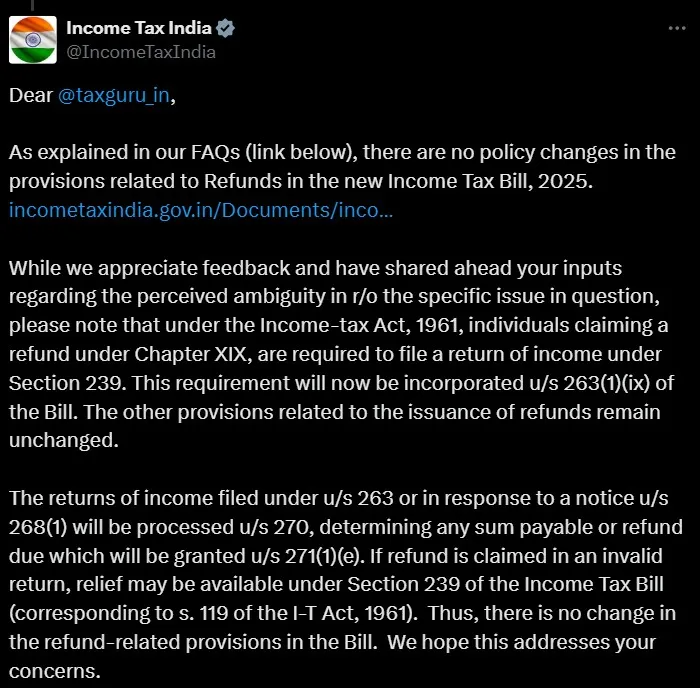

Income Tax Department’s clarification on income tax refund

To remove the apprehensions related to income tax refund, the Income Tax Department has given its clarification. In this, the department has clarified that there is going to be no change in the rules of income tax refund even after the implementation of the new tax bill. Replying to a question asked by a tax expert through social media, the department said that the already existing provisions have been added in section 263(1)(ix) of the new Income Tax Bill. Income tax returns filed under section 263 or in response to the notice of section 268(1) will be processed under section 270 and if any refund is due, it will be issued under section 271(1)(e).

Will there be a refund on filing ITR late in the new rules as well?

The answer given by the Income Tax Department means that even after the implementation of the new Income Tax Bill, the facility of getting tax refund on late filed ITR will remain the same as before. That is, even after the implementation of the new Income Tax Bill, if a taxpayer files ITR after the deadline i.e. 31 July, he will still be able to claim tax refund. Relief can also be obtained under section 239 on the refund claimed in an invalid return.

Most Read Articles:

- Reliance Jio: Good news! Jio users are getting free access to JioHotstar for three months, check details

- Employees DA Hike Update: Another gift for employees-pensioners, DA will increase by this much percentage, benefit of arrears, know how much the salary will increase?

- Credit Card Link UPI: Link your credit card to UPI from home, know step-by-step guide