Income Tax Rate: After an income in India, people also have to pay tax on it. Tax rates are also different on different incomes. As per the Income Tax Act of India, income tax is levied on income earned by all individuals, HUFs, partnership firms, LLPs and corporates.

Income Tax Slab: After an income in India, people have to pay tax on it as well. Tax rates are also different on different incomes. As per the Income Tax Act of India, income tax is levied on income earned by all individuals, HUFs, partnership firms, LLPs and corporates. In the case of individuals, if someone’s income exceeds the minimum limit, then tax is levied according to the slab system. Indian Income Tax taxes individual taxpayers on the basis of a slab system. The slab system means that different tax rates are prescribed for different categories of income. This means that with the increase in the income of the taxpayer, the tax rates of the tax go on increasing.

Tax Regime

This type of taxation enables a progressive and fair tax system in the country. Such income tax slabs undergo changes during every budget. These slab rates are different for different categories of taxpayers. At the same time, there are currently two tax regimes in the country, according to which tax is collected. These are known as New Tax Regime and Old Tax Regime.

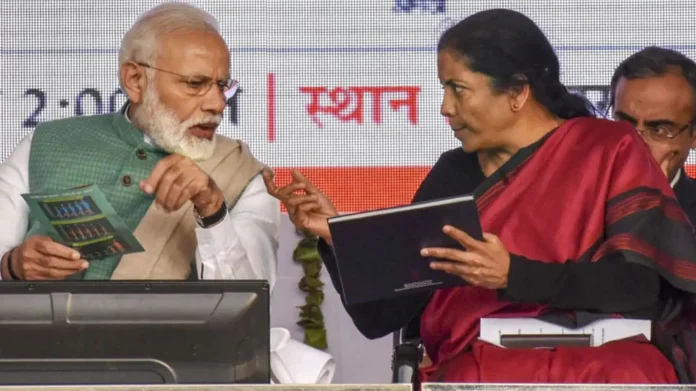

The Union

Budget is going to be presented by the Finance Minister in a few days. On the other hand, if we look at the New Tax Regime and the Old Tax Regime for FY 2021-22, then a lot of difference will be seen. In these tax slabs, tax is charged at different rates for income up to Rs 10 lakh.

5 percent difference

In the New Tax Regime for FY 2021-22, tax has to be paid at the rate of 15 percent on annual income of Rs. 7.5 lakh to Rs. 10 lakh. Whereas it is not so in Old Tax Regime. In the Old Tax Regime, individual taxpayers below 60 years of age will have to pay 20 per cent tax on annual income between Rs 5 lakh and Rs 10 lakh. In such a situation, there is a difference of 5% in both the tax regimes for FY 2021-22 on an annual income of up to Rs 10 lakh.

Old tax regime

- Income up to 2.5 lakhs—-0% tax

- Income from Rs 2,50,001 to Rs 5 lakh —- 5% tax

- Income from Rs 5,00,001 to Rs 7.5 lakh —- 20% tax

- Income from Rs 7,50,001 to Rs 10 lakh —- 20% tax

- Income from Rs 10,00,001 to Rs 12.5 lakh —- 30% tax

- Rs 12,50,001 to Rs 15 lakh —- 30% tax

- 30% tax on income above Rs 15,00,000 lakh

New tax regime

- Income up to 2.5 lakhs—-0% tax

- Income from Rs 2,50,001 to Rs 5 lakh —- 5% tax

- Income from Rs 5,00,001 to Rs 7.5 lakh —- 10% tax

- Income from Rs 7,50,001 to Rs 10 lakh —- 15% tax

- Income from Rs 10,00,001 to Rs 12.5 lakh —- 20% tax

- 12,50,001 to Rs 15 lakh —- 25% tax

- 30% tax on income above Rs 15 lakh