Nirmala Sitharaman said, “In the year 2020, I introduced the new personal income tax regime with six income slabs starting from Rs 2.5 lakh. Now I am going to reduce the number of slabs to five and increase the tax exemption limit to Rs 3 lakh. I propose a change in the system.

New Delhi :Union Finance Minister Nirmala Sitharaman has increased the exemption limit for private taxpayers from Rs 5 lakh to Rs 7 years. Presenting the General Budget 2023 in Parliament on Wednesday, he said, “At present, in both the new and old tax regimes, those earning up to five lakh rupees do not pay any income tax. I am in favor of increasing the exemption limit in the new tax regime.” I propose to do 7 lakh rupees. This means that in the new tax regime, a person will not have to pay any tax till the income of up to 7 lakh rupees. The Finance Minister also announced new tax slabs.

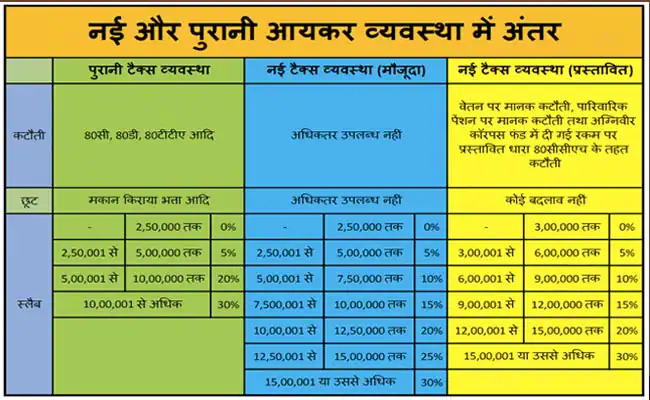

*New Tax Slabs*

- Income up to Rs 0-3 lakh: No tax Income up to

- Rs 3-6 lakh: 5% Income

- Up to Rs 6-9 lakh: 10% Income

- Up to Rs 9-12 lakh: 15%

- Income up to Rs 12-15 lakh: 20%

- Income above Rs 15 lakh: 30%

Nirmala Sitharaman said, “In the year 2020, I introduced the new personal income tax regime with six income slabs starting from Rs 2.5 lakh. Now I am going to reduce the number of slabs to five and increase the tax exemption limit to Rs 3 lakh. I propose a change in the system.

In Budget 2020, the Finance Minister had given the option to the private taxpayer to either go to the old regime, under which they can avail tax exemption, or to go to the new regime, in which there is no option to claim exemption. In the old tax regime, the tax rate was 30 per cent for those whose annual income was Rs 15 lakh but they could claim exemption.

Those who opted for the new tax regime announced for the first time in 2020 and whose income was more than Rs 15 lakh were taxed at 25 per cent but could not claim exemption.

Learn from the example below how you can save more with the new tax regime,

if your salary is seven lakh rupees annually, then you will not have to pay any tax. Earlier this exemption was five lakh rupees annually.

If your salary is Rs 9 lakh per annum, then the amount will be taxed by dividing it into slabs. As per..

A.Rs 0-3 lakh: No tax (earlier it was Rs 0-2.5 lakh)

Now the remaining amount of Rs 6 lakh will be taxed under two slabs i.e. 5 percent for the portion of Rs 3-6 lakh and 10 per cent for portion of Rs 6-9 lakh

B. 5% tax on Rs 3 lakh: Rs 15,000

Balance of Rs 3 lakh will be taxed under one slab i.e. portion of ₹ 6-9 lakh 10%

C. 10% tax on Rs 3 lakh: Rs 30,000

Thus the total tax on an amount of Rs 9 lakh (total sum of A, B and C): Rs 45 thousand

However, if the tax on this ₹ 9 lakh was calculated using the old slab (Rs 0-2.5 lakh exemption and ₹ 5 lakh exemption), you would have to pay Rs 60,000 which means a saving of 25 per cent over the new slab Has been