Income Tax Slab Change: If your annual income is below Rs 15 lakh, then you will be happy. You are going to get a big relief in income tax in the budget to be presented next month.

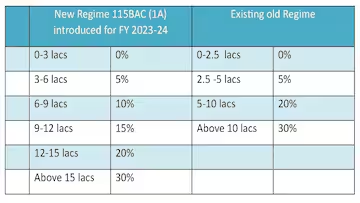

According to information received by CNBC Awaaz from sources, the government is preparing to give a big relief to the middle class in this year’s budget. For this, different options are being considered. The most likely possibility is that the slab of 20% and 30% in the new tax regime should be changed. Currently, if your taxable income is up to Rs 15 lakh, then up to 20% tax is levied. As it goes above this, your tax liability increases from 20% to 30%.

What is going to happen now? According to sources, the Finance Ministry can make changes in it. One option is to bring another tax slab in it

or the tax rates should be changed. The thinking of the Finance Ministry behind this is that if money goes into the hands of the people of this income group, they will spend it.

This will create demand in the economy. Which is the biggest challenge at this time. Apart from this, changes can also be made in the tax slabs below it.

To make the new tax regime attractive, it is also being considered to increase the tax exemption limit from Rs 3 lakh to at least Rs 5 lakh. With this, there will be a natural change in 5%, 10% and 15%.

However, if sources are to be believed, a section of the Finance Ministry is in favor of giving relief in the old tax regime as well. The Economic Advisory Department has recommended that along with the new tax regime, relief should also be given in the old tax regime.

Because still a large number of tax payers are in the old tax regime. If they are not given relief, then the purpose of tax exemption will not be fulfilled.

Another source says that the Income Tax Department is not in favor of this. Because the government does not want to continue the old tax regime for a long time.

However, all options are open right now. The final decision is likely to be taken a week before the budget is presented. Before this, a long meeting will also be held between the Prime Minister’s Office and the Finance Ministry.

The only purpose of all these changes is to give as much money as possible to the people. However, before the assembly elections in four states, the government would also like to please the middle class.

The country’s well-known tax expert Sharad Kohli says that since the new tax regime came in the year 2020, the government’s step-motherly behavior is being seen with those in the old tax regime.

The middle class does not like this. Because they have a lot of savings. That is why they do not like the new tax regime. This habit is also good. That is why more than two-thirds of the taxpayers are in the old tax regime.

This makes one thing clear that the new tax regime has not been that successful. As much as the government intended.

As long as the old tax regime is in place, step-motherly treatment is not right. The government should change this too.

Along with this, the definition of middle class has also changed. Along with the increase in inflation, income has also increased. Now the middle class earns 20-25 lakh rupees. They should also get tax exemption.