The government has fixed the floor price of Rs 1367 for the offer for sale, after which IRCTC shares saw a big drop on Wednesday morning.

The government is selling a 20 per cent stake in IRCTC through Offer for Sale. The window for the offer for sale will open on December 10 and 11. On December 11, only retail investors can invest in it. The government has raised the floor price to Rs 1367 per share for the offer for sale. Which is down 15.51 percent over Tuesday’s closing price. IRCTC shares closed at Rs 1618.05 per share on Wednesday.

Its effect was clearly visible on the shares of IRCTC on Thursday morning. IRCTC shares opened at Rs 1405, down 13.16 percent on Wednesday morning. However, its shares later improved. IRCTC shares were trading 7.20 per cent down at Rs 1501 at 10.30 am.

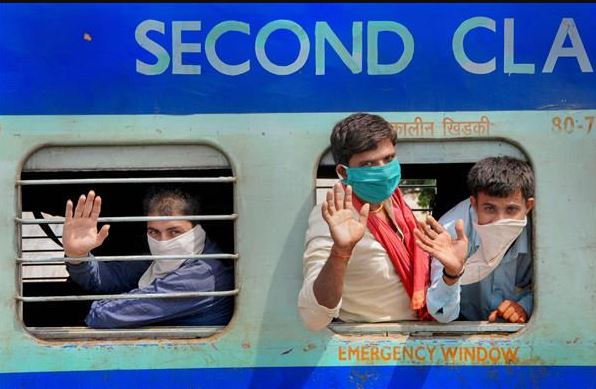

Indian Railways, IRCTC: After 108 days, this 108 year old train started running on the track again from December 1, Army soldiers will get the facility

The government has proposed to sell 24 million shares through the Offer for Sale. This is 15% of the paid-up equity of the company. The government will sell this stake through the offer sale. The government also has a plan that it will sell another 0.8 crore shares on oversubscription. This is 5% of the total paid up capital of IRCTC. Overall, the government is set to sell a 20 per cent stake in IRCTC through Offer for Sale. When a public issue comes after the IPO, it is called Offer for Sale.

Having sold its stake in IRCTC will help the government achieve the target of disinvestment. The government has set a disinvestment target of Rs 2.10 lakh crore in this financial year. Of this, 1.20 lakh crore rupees will be received from selling stake in government companies and the remaining 90,000 crores will be raised from stake sale in financial institutions.

The government has a total stake of 87.40 per cent in IRCTC. As per Sebi regulations, the government has to reduce its stake to 75 per cent. IRCTC was listed in October 2019 and raised Rs 645 crore through an IPO.

In April 2017, the Union Cabinet approved the listing of five railway companies. Four companies – IRCON International Ltd, RITES Ltd., Rail Vikas Nigam and IRCTC have already been listed. Now IRFC may be listed in the next fiscal year.