It is a risk management technique in which an investor sets aside a sum of money to be used to remedy an unexpected loss.

Many a time we sit back and think – Is it better to buy a life insurance to protect our family or should we invest the amount required to pay the insurance premium in some financial instrument and generate wealth out of it over a period of time as a form of ‘self-insurance’.

What is a self-insurance?

‘Self-insurance’ is a risk management technique in which an investor sets aside a sum of money to be used to remedy an unexpected loss. It is a step taken to prevent the risk by creating a good corpus against emergency need by investing monies in financial instruments other than any insurance product. However, in normalcy, you can self-insure against any type of losses whether it has to be against a life or non-life one.

Is it right to think of going in for self-insurance? Amar Pandit, Founder & Chief Happiness Officer at HappynessFactory.in said that there are two critical issues with the proposition of creating “self-insurance” as against buying life insurance. First, an insurance policy gives protection from the day you sign the dotted line, whereas, an investment corpus takes years to grow big enough. Second, the premiums for getting protection with a term policy would cost just a fraction of the investments required to grow a corpus of the same size. “For instance, if annual premiums for a Rs 1 crore term cover for a 30-year-old is Rs 10,000, building a corpus of Rs 1 crore would require monthly contributions of Rs 20,000 for 15 years, assuming the investments grow at a rate of 12%,” he said.

Here are five key points to know why buying a life insurance policy can be a better way to protect one’s family rather than taking time in building the same corpus as equals to sum assured, by investing in some other financial products.

Coverage from Day One

When you think of protecting your family from uncertainties, life insurance policy does it so. While it takes years to build a corpus of lakhs of rupees, taking an insurance policy, covers you from day one providing you protection with lakhs of rupees (which is your Sum Assured).

Guaranteed Growth and Money Stability

Mostly, the schemes are market-linked and not guaranteed, especially when you invest your money in stocks or mutual funds to get good returns. However, in case of life insurance, many traditional insurance plans give you guaranteed returns on your investment when it comes to maturity along with death benefit cover.

Tax Exemption

While tax may be applicable to returns you get from investing in other financial instruments, returns from life insurance product are exempted from tax under section 80C and 10(10D) of Income Tax Act. “There is a reason why families since ages have been investing in life insurance to save and grow their money. The death payouts help in the long run along with the benefit of tax exemption. Also, there is a benefit of additional riders in Life insurance. No other type of investment has all these benefits,” said Naval Goel- CEO and Founder of PolicyX.com.

Access to Cash Value at any time

The facility of borrowing cash and using it anytime from the pool is available under life insurance policy while the same facility cannot be accessed before a certain period of time when making investments in some of the other financial instruments.

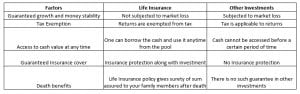

Here is a snapshot of the difference between actual life insurance and self-insurance:

Guaranteed Insurance Cover

Every insurance policy provides protection first after which you get the investment component attached. However, no insurance protection is assured while investing money in financial instruments other than insurance.

Death Benefits

Life Insurance policy gives you surety of sum assured to your family members after death. Moreover, even if you have not paid all your premium amount, your family gets the death benefit cover amount. However, in case of creating corpus through other instruments, there is no such guarantee of getting such benefit.