MUMBAI: Does the intention of a company or an investor while making an investment determine the tax outgo? It does, as per a recent tax ruling. And experts say the ruling, which said the tax depended on whether the investment was for strategic purposes or merely a short-term one, could open a Pandora’s box of tax litigations.

A recent Income Tax Appellate Tribunal (ITAT) ruling has distinguished between ‘stock in trade’ and ‘controlling interest’, allowing higher deductions and lower taxable income if the stock held by the taxpayer was ‘stock in trade’.

While the ruling could help several companies and investors, it would reopen a matter that was considered shut after a Supreme Court decision, tax experts said.

This was one of the issues that had maximum litigation till about a year back until the SC decision, they said.

As per the SC judgement, if a company or individual has a tax-free income then corresponding expenditure for such an income is not permitted as deduction. So, any company or individual receiving dividend income cannot deduct administrative expenses.

ITAT, however, has interpreted the top court decision in a different way and said if the shares were acquired merely to be held as ‘stock in trade’ then deductions should be allowed. Many holding companies of business groups, corporates and MNCs with subsidiaries and even individuals investing in stocks may now litigate for a lower tax outgo, experts said.

“The issue of disallowance under Section 14A is a contagious issue and litigation is rampant,” said Dilip Lakhani, a senior chartered accountant.

“The investors treat the investment as capital asset or stock in trade and if it’s the latter then profit is taxed as business income as the intention is to trade and earning dividend is not the prime motive. ITAT decision will support the argument that corresponding expenses be allowed.”

As an example, let’s say an investor borrows Rs 50 lakh to buy stocks, pays interest of Rs 5 lakh, earns a dividend of Rs 1 lakh, and then sells the shares few months later to make a gain of Rs 10 lakh. Now, the question is whether the investor can set off Rs 5 lakh as his expenses, or not?

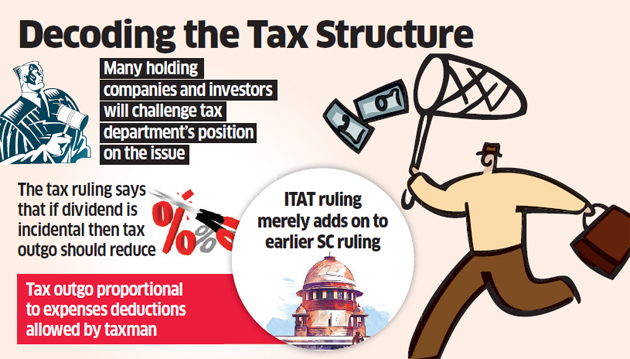

As per the tax department’s position, the expenses would be disallowed, but following the ITAT ruling it would be debated whether the investment was strategic, or the dividend income was incidental and the shares were merely stock in trade in the hands of the investor when the dividend income was received.

Tax experts, however, clarified that ITAT ruling does not contradict the SC judgement, but adds on to it.

The top court had partly upheld the tax department’s view that investors, be it companies or individuals, cannot take double advantage. That is, they cannot avoid tax on exempt income like dividend (and, till recently, long-term capital gains) as well as lower taxable income by treating the interest on loans Now, ITAT has relied upon an earlier SC judgement in upholding the dominant purposes test for the purposes of making disallowance under Section 14A of the Income-tax Act, said Amit Singhania, partner at law firm Shardul Amarchand. “This judgement again emphasises on how significant is to preserve documentation to proof the dominant intention (stock in trade versus strategic investment) of the taxpayer in holding the stock. This judgement should give relief to taxpayers who engage in trading port ..

who engage in trading portfolio of stocks,” he said.

Industry trackers said litigation on the issue was high as several companies with investment in subsidiaries and high net-worth investors would challenge the tax department’s stand to disallow expenses.