With the issuance of the return form for 2021-22, the Income Tax Department has appealed to the taxpayers to fill it soon. The department is also making them aware by sending SMS from time to time and it is also telling that before filling the ITR form this time, match your data with other documents.

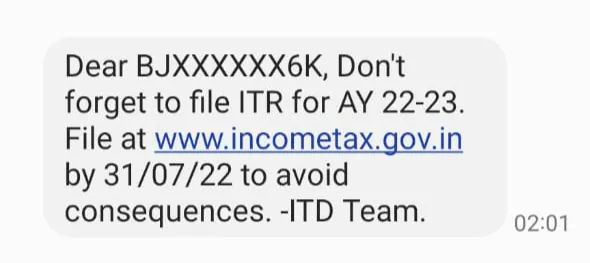

New Delhi. The Income Tax Department has fixed July 31 as the last date for filing income tax return forms for the financial year 2021-22 and is also making taxpayers aware by sending SMS repeatedly. This time many types of SMS are coming from the department, due to which confusion is also arising among the taxpayers.

You will also have different types of SMS coming from time to time from the Income Tax Department. There is no need to panic about this and there is no need to create any kind of confusion. Once you understand the messages given in these SMS, things will become easy for you. With the help of this, you will also be able to fill your ITR in a better and easier way.

What is meant by data verification

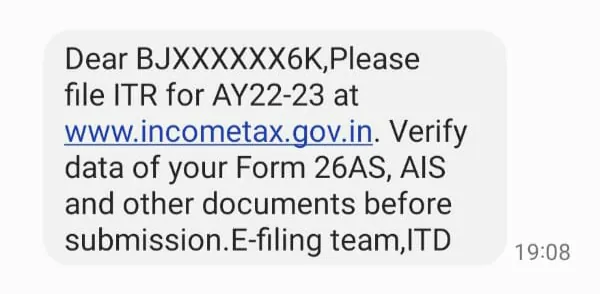

The Income Tax Department is sending a new message to the taxpayers this time. In this, they are being asked to reconcile their documents and verify all the data before filing ITR. In such SMS coming from the Income Tax Department, it is being said that before filing ITR, it is being said to collate your data through documents like Form 26AS and Annual Information Statement (AIS).

This time the Income Tax Department is giving all the data related to annual transactions by including it in AIS, which will not only make it easier to file returns but also increase transparency. Apart from this, your investment information will also be there in Form 26AS, which will have to be verified by matching the information given in the ITR form. You can download both these forms from the website of Income Tax Department.

FAST ITR FILLING MESSAGE

In yet another type of SMS, the Income Tax Department asks taxpayers to file their Income Tax Returns at the earliest. In this SMS, citing the last date for filing returns, taxpayers are appealed to avoid last minute rush. The department has fixed July 31 as the last date for filing income tax returns this year. In such a situation, it is better that you file your return early without delay.