The last date to file ITR is 31st July 2022. After this, you will have to pay a penalty on filling the ITR. Citing technical difficulties in filing ITR, people are demanding extension of the deadline.

New Delhi. Today is the last day to file Income Tax Return (ITR) for the financial year 2021-22 (AY 2022-23). Taxpayers are left with only a few hours from now to file ITR. Penalty will have to be paid for not filing ITR within the deadline. However, the problem is that on the last day of filing ITR, many people are unable to file ITR due to technical difficulties.

This type of error is coming to the users on the Income Tax website

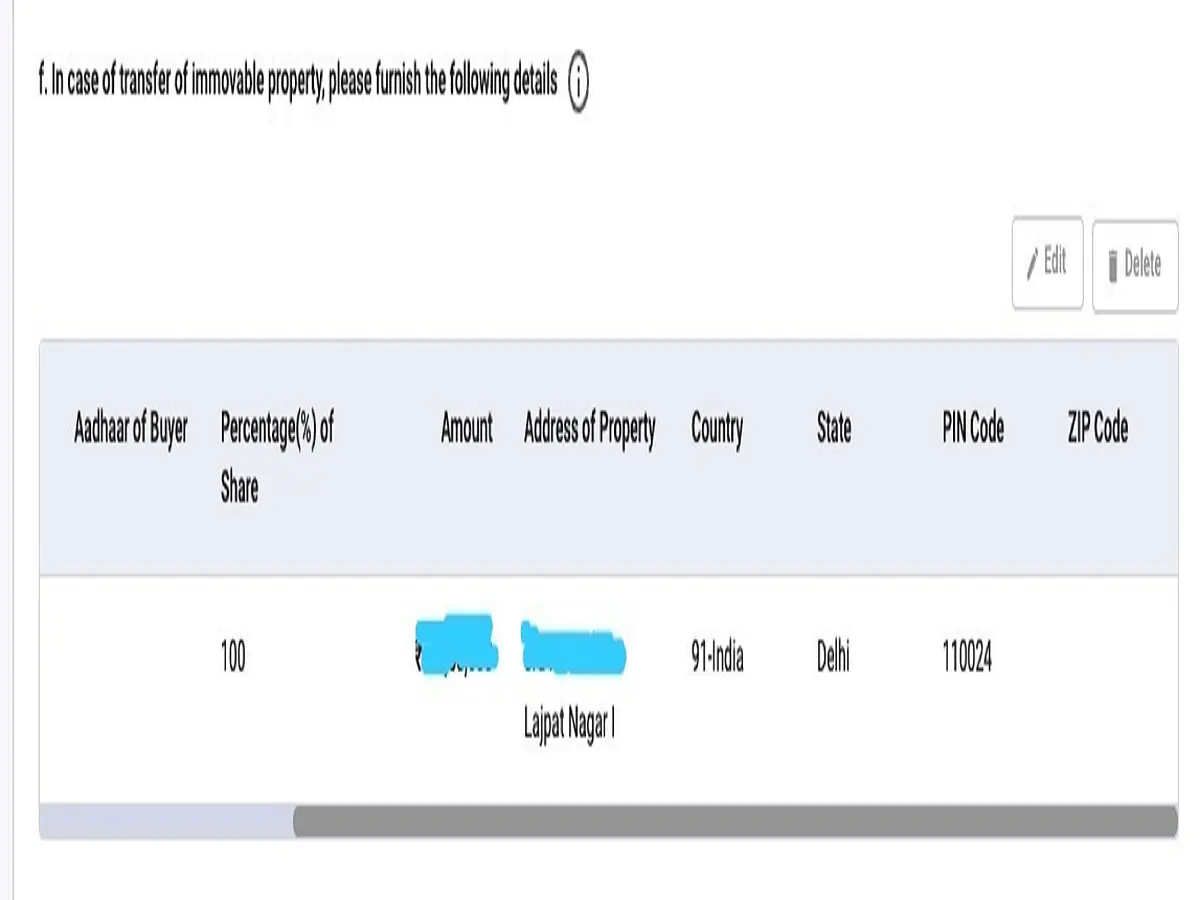

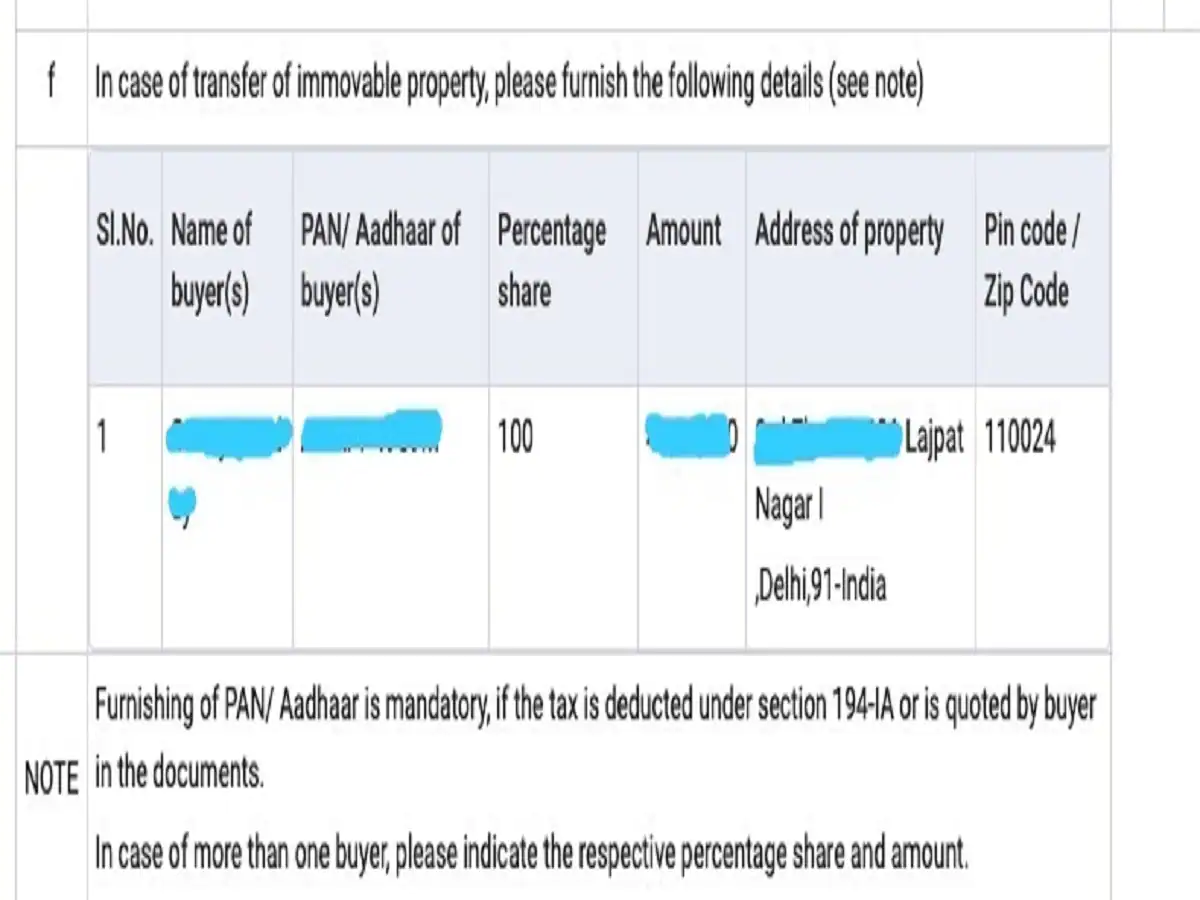

1. Validation is failing. Zip code is being asked.

2. Zip code is appearing different from the pin code in the description. Though it is not a field while entering the details in the online form

3. Preview is also showing Zip code and Pin code as a single field but users are unable to proceed.

These errors are coming in cases where the users are making capital gains from the sale of the property.

Efforts to extend the last date on social media Intensified

Through social media, people are also demanding to increase the deadline for filling ITR. Behind this, they are citing technical difficulties in filing ITR. In the past, many hashtags trended on Twitter and are happening even today.

Income Tax Department released FAQ

The Income Tax Department has released a set of Frequently Asked Questions. Here are the answers to 10 major questions that taxpayers asked while filing ITR.

Corporates and businessmen have to file returns by October 31,

The date of filing IT returns varies according to the category of taxpayers. Salaried people have to file ITR by 31st July while corporates and businessmen have to file returns by 31st October.